Understanding the Car Loan Interest Rate for 700 Credit Score: What You Need to Know

Guide or Summary:Car Loan Interest Rate for 700 Credit ScoreFactors Influencing Car Loan Interest Rate for 700 Credit ScoreHow to Secure the Best Car Loan I……

Guide or Summary:

- Car Loan Interest Rate for 700 Credit Score

- Factors Influencing Car Loan Interest Rate for 700 Credit Score

- How to Secure the Best Car Loan Interest Rate for 700 Credit Score

- Managing Your Car Loan Effectively

Car Loan Interest Rate for 700 Credit Score

When it comes to financing a vehicle, your credit score plays a crucial role in determining the car loan interest rate you will be offered. For those with a credit score of 700, which is generally considered good, the interest rates can be quite favorable. In this article, we will explore the factors that influence the car loan interest rate for a 700 credit score, how to secure the best rates, and tips for managing your auto loan effectively.

Factors Influencing Car Loan Interest Rate for 700 Credit Score

The car loan interest rate for a 700 credit score is typically lower than that for individuals with lower credit scores. Lenders view a score of 700 as a sign of responsible credit management, which reduces their risk. However, several factors can still influence the specific interest rate you may receive:

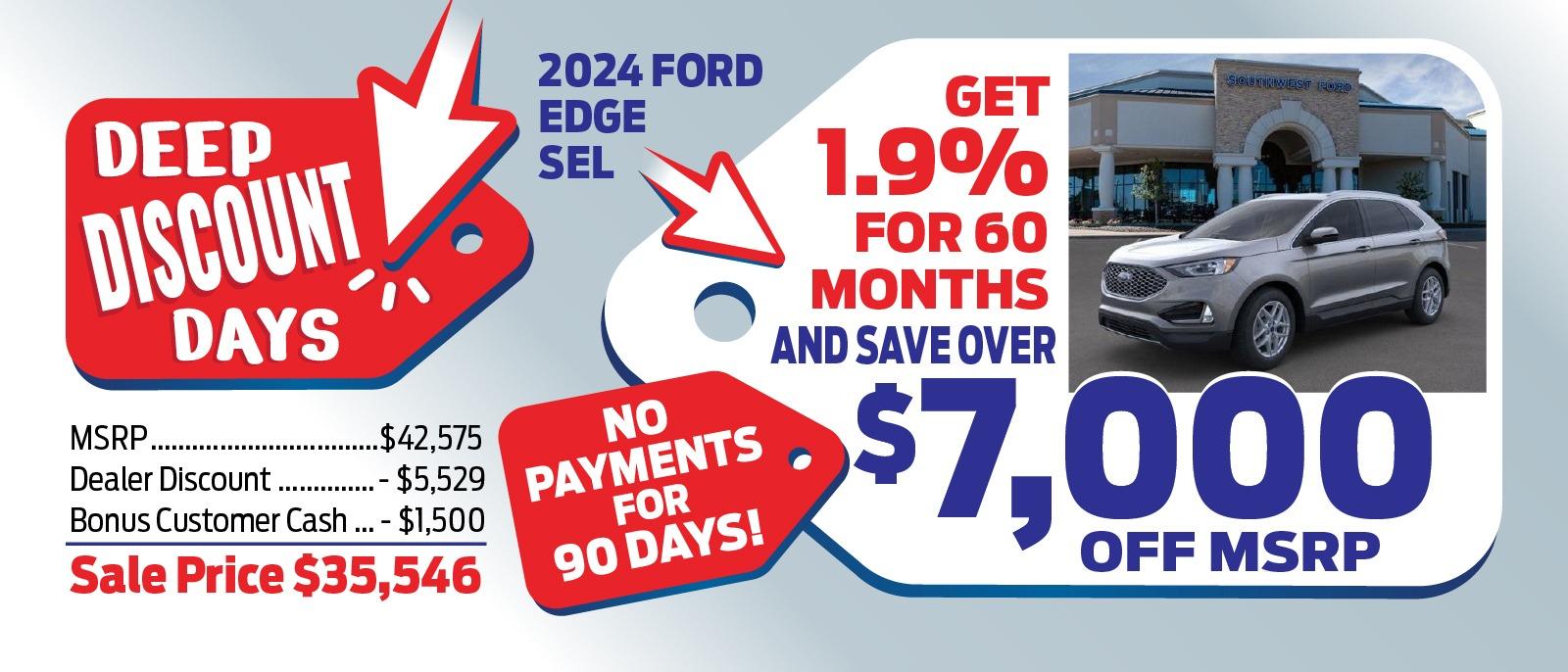

1. **Lender Policies**: Different lenders have varying policies and risk assessments. Some may offer more competitive rates than others, even for the same credit score.

2. **Loan Term**: The length of the loan can affect the interest rate. Generally, shorter loan terms come with lower interest rates, while longer terms may result in higher rates.

3. **Down Payment**: A larger down payment can reduce the amount you need to borrow and may lead to a lower interest rate. Lenders often reward borrowers who can provide a substantial down payment.

4. **Vehicle Type**: New cars often come with lower interest rates compared to used cars. Lenders may perceive new vehicles as less risky investments.

5. **Market Conditions**: Economic factors and market trends can also impact interest rates. It's essential to stay informed about current market conditions when applying for a loan.

How to Secure the Best Car Loan Interest Rate for 700 Credit Score

To ensure you get the best possible car loan interest rate for your 700 credit score, consider the following strategies:

1. **Shop Around**: Don't settle for the first offer you receive. Compare rates from multiple lenders, including banks, credit unions, and online lenders.

2. **Negotiate**: Once you have several offers, don't hesitate to negotiate. If you find a better rate elsewhere, let your preferred lender know. They may be willing to match or beat the offer.

3. **Improve Your Credit Score**: If you have time before purchasing your vehicle, consider taking steps to improve your credit score further. Paying down existing debts, making timely payments, and correcting any errors on your credit report can help.

4. **Consider Pre-Approval**: Getting pre-approved for a loan can give you a better idea of the interest rate you may qualify for. It also shows sellers that you are a serious buyer.

5. **Evaluate Loan Terms**: Look beyond the interest rate. Consider the overall terms of the loan, including fees, repayment flexibility, and any penalties for early repayment.

Managing Your Car Loan Effectively

Once you've secured a car loan, managing it effectively is crucial. Here are some tips to ensure you stay on top of your payments and maintain your financial health:

1. **Set Up Automatic Payments**: This can help you avoid late fees and ensure your payments are made on time.

2. **Create a Budget**: Include your car payment in your monthly budget to ensure you can comfortably afford it.

3. **Make Extra Payments**: If possible, make extra payments toward the principal. This can help you pay off the loan faster and save on interest.

4. **Monitor Your Credit**: Regularly check your credit report to ensure there are no errors that could affect your score and future borrowing ability.

5. **Communicate with Your Lender**: If you encounter financial difficulties, reach out to your lender. They may offer options to help you manage your payments.

In conclusion, understanding the car loan interest rate for a 700 credit score is essential for making informed financial decisions. By considering the factors that influence your rate and following strategies to secure the best terms, you can successfully navigate the car buying process and manage your loan effectively.