Unlock Your Financial Freedom with an 8k Loan Bad Credit: Your Path to Quick Cash Solutions

In today's fast-paced world, financial emergencies can arise unexpectedly, leaving individuals searching for quick and reliable funding options. If you find……

In today's fast-paced world, financial emergencies can arise unexpectedly, leaving individuals searching for quick and reliable funding options. If you find yourself in a situation where you need immediate cash but have bad credit, an 8k loan bad credit can be a viable solution to help you regain control of your finances. This guide will delve into the benefits, eligibility criteria, and the application process for securing an 8k loan bad credit.

#### Understanding 8k Loan Bad Credit

A loan of $8,000 can be a game-changer for those facing financial difficulties. Whether you need to cover medical bills, car repairs, or unexpected expenses, having access to this amount can provide the relief you need. However, many traditional lenders are hesitant to approve loans for individuals with bad credit scores. Fortunately, there are alternative lending options available that cater specifically to those with less-than-perfect credit histories.

#### The Benefits of an 8k Loan Bad Credit

1. **Quick Access to Funds**: One of the most significant advantages of applying for an 8k loan bad credit is the speed at which you can receive your funds. Many online lenders offer fast approval processes, with some providing funds within 24 hours.

2. **Flexible Use**: Unlike some loans that come with restrictions on how the money can be spent, an 8k loan bad credit typically allows you to use the funds for any purpose. This flexibility means you can address your most pressing financial needs without worrying about lender stipulations.

3. **Improving Your Credit Score**: Taking out a loan and making timely payments can positively impact your credit score over time. By demonstrating responsible borrowing behavior, you can improve your creditworthiness for future loans.

4. **Tailored Repayment Plans**: Many lenders understand the challenges faced by individuals with bad credit and offer customizable repayment plans. This means you can choose a plan that fits your budget and financial situation.

#### Eligibility Criteria for an 8k Loan Bad Credit

While each lender may have specific requirements, there are common eligibility criteria you should be aware of:

- **Age Requirement**: You must be at least 18 years old to apply for a loan.

- **Income Verification**: Lenders will typically require proof of income to ensure you can repay the loan. This can include pay stubs, bank statements, or tax returns.

- **Identification**: Valid identification, such as a driver’s license or passport, is necessary to confirm your identity.

- **Credit History**: While bad credit may not disqualify you, lenders will still review your credit history to assess your overall financial behavior.

#### The Application Process for an 8k Loan Bad Credit

1. **Research Lenders**: Start by researching various lenders that offer loans for individuals with bad credit. Compare interest rates, terms, and customer reviews to find a reputable lender.

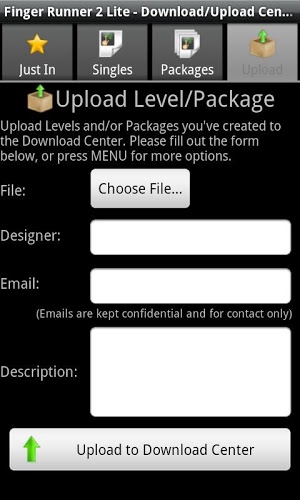

2. **Fill Out an Application**: Once you’ve chosen a lender, complete their online application form. Be prepared to provide personal information, income details, and any other required documentation.

3. **Review Loan Offers**: After submitting your application, the lender will review your information and may provide you with loan offers. Take your time to review the terms and conditions before accepting an offer.

4. **Receive Your Funds**: Once you accept a loan offer, the lender will disburse the funds to your bank account, often within a short timeframe.

#### Conclusion

An 8k loan bad credit can be a lifeline for those facing urgent financial challenges. With quick access to funds, flexible usage, and the potential to improve your credit score, this type of loan can help you navigate through tough times. Remember to research your options, understand the eligibility criteria, and choose a lender that meets your needs. By taking these steps, you can unlock the financial freedom you deserve and pave the way for a brighter financial future.