Unlock Savings with Refinance Car Loan USAA: Your Guide to Lower Payments and Better Rates

Guide or Summary:Refinance Car Loan USAA: A Smart Financial MoveWhy Choose USAA for Refinancing?The Benefits of Refinancing Your Car LoanHow to Refinance Yo……

Guide or Summary:

- Refinance Car Loan USAA: A Smart Financial Move

- Why Choose USAA for Refinancing?

- The Benefits of Refinancing Your Car Loan

- How to Refinance Your Car Loan with USAA

- Tips for Successful Refinancing

---

Refinance Car Loan USAA: A Smart Financial Move

If you're a member of USAA and looking for ways to save on your car loan, refinancing might be the perfect solution for you. With the rising cost of living and fluctuating interest rates, many car owners are turning to refinancing as a way to reduce their monthly payments and overall loan costs. In this comprehensive guide, we will explore the benefits of refinancing your car loan through USAA, how the process works, and tips to ensure you get the best deal possible.

Why Choose USAA for Refinancing?

USAA is renowned for its commitment to serving military members, veterans, and their families. One of the standout features of USAA is its competitive interest rates and flexible terms, making it an ideal choice for refinancing your car loan. By choosing USAA, you can benefit from:

1. **Lower Interest Rates**: USAA often offers lower rates compared to traditional banks and lenders, which can significantly reduce your monthly payments.

2. **No Hidden Fees**: Transparency is key at USAA. You won’t have to worry about hidden fees or unexpected charges when refinancing your car loan.

3. **Exceptional Customer Service**: USAA is known for its outstanding customer support, ensuring you have assistance throughout the refinancing process.

The Benefits of Refinancing Your Car Loan

Refinancing your car loan with USAA can yield several advantages:

- **Reduced Monthly Payments**: By securing a lower interest rate, you can decrease your monthly payments, freeing up cash for other expenses.

- **Shorter Loan Terms**: If you want to pay off your car loan faster, refinancing can allow you to shorten the loan term while keeping your payments manageable.

- **Access to Cash**: If your car's value has increased, refinancing can also allow you to take out extra cash for other financial needs.

How to Refinance Your Car Loan with USAA

The refinancing process with USAA is straightforward and can typically be completed online. Here are the steps you need to follow:

1. **Check Your Credit Score**: Before applying, check your credit score. A higher score can qualify you for better rates.

2. **Gather Necessary Documents**: Have your current loan information, proof of income, and vehicle details ready.

3. **Apply Online**: Visit the USAA website to fill out the refinancing application. Provide accurate information to expedite the process.

4. **Review Loan Offers**: Once your application is processed, USAA will present you with various loan offers. Review the terms carefully.

5. **Finalize the Loan**: Choose the best option for your financial situation and complete the necessary paperwork.

Tips for Successful Refinancing

To maximize your savings when refinancing your car loan with USAA, consider the following tips:

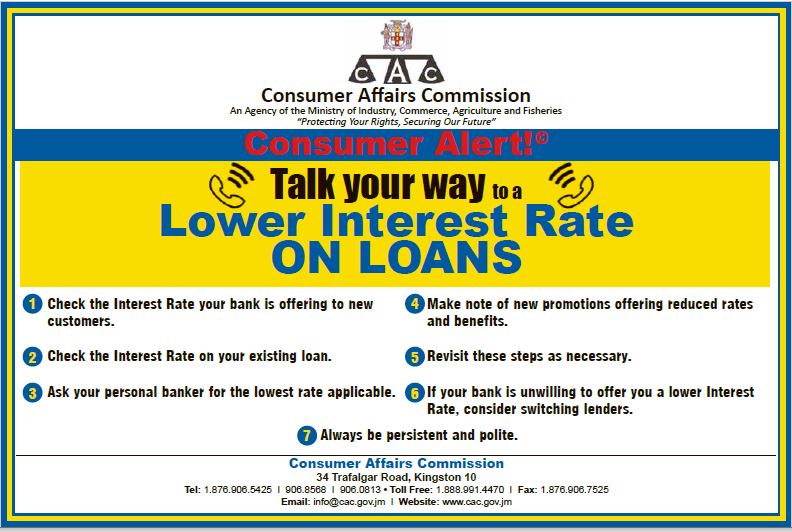

- **Compare Offers**: Even though USAA provides competitive rates, it’s wise to compare offers from other lenders to ensure you’re getting the best deal.

- **Consider Timing**: Interest rates fluctuate, so timing your refinance can make a significant difference in the rates you receive.

- **Negotiate Terms**: Don’t hesitate to negotiate the terms of your loan. USAA may be willing to work with you to meet your financial needs.

- **Stay Informed**: Keep an eye on your credit score and financial situation to determine the best time to refinance in the future.

Refinancing your car loan with USAA can be a smart financial decision that leads to significant savings. With lower interest rates, no hidden fees, and excellent customer service, USAA stands out as a top choice for refinancing. By understanding the benefits and following the refinancing process, you can take control of your car loan and improve your overall financial health. Don’t wait—explore your refinancing options with USAA today and unlock the potential for savings!