Unlock Instant Cash: How to Easily Payday Loans Apply Online

Guide or Summary:Why Choose Payday Loans Apply Online?The Simple Application ProcessInstant Access to FundsFlexible Loan AmountsConsiderations Before Applyi……

Guide or Summary:

- Why Choose Payday Loans Apply Online?

- The Simple Application Process

- Instant Access to Funds

- Flexible Loan Amounts

- Considerations Before Applying

- Conclusion: Take Control of Your Finances Today

In today’s fast-paced world, financial emergencies can arise unexpectedly, leaving many individuals in need of quick cash solutions. If you find yourself in such a situation, understanding how to effectively utilize payday loans can be a game changer. With the convenience of technology, you can now apply for payday loans online, making the process easier and more accessible than ever before.

Why Choose Payday Loans Apply Online?

Payday loans are short-term loans designed to provide immediate financial relief. They are typically used to cover unexpected expenses such as medical bills, car repairs, or urgent home needs. The primary advantage of choosing to apply online is the speed and convenience it offers. Traditional loan applications can be time-consuming, requiring you to visit a bank, fill out lengthy forms, and wait for approval. In contrast, payday loans apply online streamline this process, allowing you to submit your application from the comfort of your home, at any time of day.

The Simple Application Process

One of the most appealing aspects of payday loans apply online is the straightforward application process. Most online lenders have simplified their forms to ensure that you can complete your application in just a few minutes. Typically, you’ll need to provide basic personal information, proof of income, and a valid bank account. Once submitted, many lenders offer instant approval or a quick response time, so you won’t be left waiting in uncertainty.

Instant Access to Funds

Once your application for payday loans apply online is approved, you can expect to receive your funds within a short timeframe—often within 24 hours. This rapid access to cash can be crucial in times of financial strain, allowing you to address your pressing financial needs without delay. Whether it’s paying off a bill to avoid late fees or covering an emergency expense, payday loans can provide the financial support you need when you need it most.

Flexible Loan Amounts

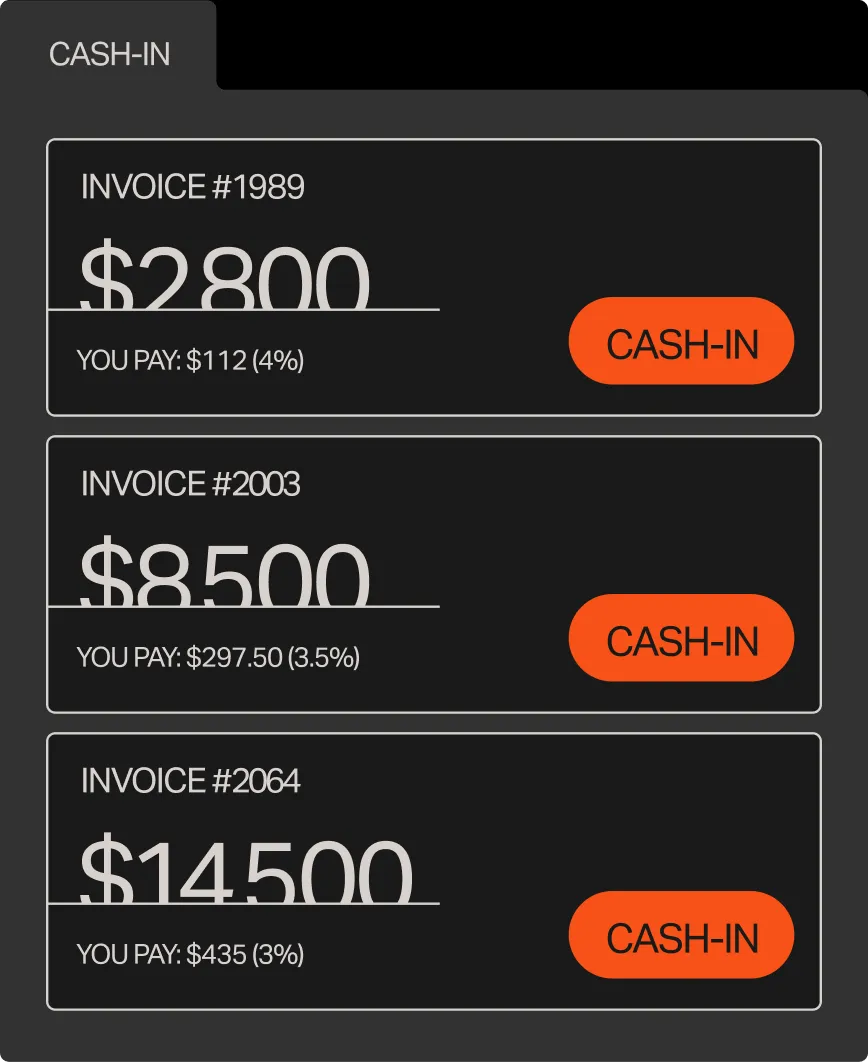

Another benefit of payday loans apply online is the flexibility in loan amounts. Depending on your financial situation and the lender’s policies, you can typically borrow anywhere from $100 to $1,000 or more. This flexibility allows you to tailor your loan to fit your specific needs, ensuring you’re not over-borrowing or under-borrowing.

Considerations Before Applying

While payday loans offer numerous benefits, it’s essential to consider the associated risks. These loans often come with higher interest rates compared to traditional loans, which can make them more expensive if not managed properly. Before applying, ensure that you have a clear repayment plan in place to avoid falling into a cycle of debt.

Conclusion: Take Control of Your Finances Today

In conclusion, if you find yourself in a financial pinch, payday loans apply online can be a convenient and effective solution. With a simple application process, quick access to funds, and flexible loan amounts, these loans can help you regain control of your finances. However, always approach with caution and ensure you fully understand the terms before committing. By making informed decisions, you can navigate your financial challenges with confidence and ease.