Upgrade Personal Loan Review: Unlocking Financial Freedom with Flexible Options

Guide or Summary:What is Upgrade?Key Features of Upgrade Personal LoansThe Application ProcessPros and Cons of Upgrade Personal LoansWho Should Consider Upg……

Guide or Summary:

- What is Upgrade?

- Key Features of Upgrade Personal Loans

- The Application Process

- Pros and Cons of Upgrade Personal Loans

- Who Should Consider Upgrade Personal Loans?

- Final Thoughts

Are you considering a personal loan but feeling overwhelmed by the options available? Look no further! In this comprehensive Upgrade Personal Loan Review, we’ll delve into the ins and outs of this financial product, exploring its benefits, features, and what sets it apart from the competition. Whether you’re looking to consolidate debt, finance a major purchase, or cover unexpected expenses, understanding the nuances of Upgrade’s offerings can help you make an informed decision.

What is Upgrade?

Upgrade is a financial technology company that provides personal loans and credit products aimed at helping consumers achieve their financial goals. Founded in 2017, Upgrade has quickly gained popularity for its user-friendly platform and competitive loan terms. With a focus on transparency and customer service, Upgrade aims to empower borrowers by providing them with the tools and resources they need to manage their finances effectively.

Key Features of Upgrade Personal Loans

One of the standout features of Upgrade personal loans is their flexibility. Borrowers can apply for loans ranging from $1,000 to $50,000, making it suitable for a variety of financial needs. The repayment terms are also flexible, ranging from 36 to 60 months, allowing you to choose a plan that fits your budget.

Another significant advantage is the competitive interest rates. Upgrade offers rates that are often lower than those of traditional banks, making it an attractive option for borrowers with good credit. Additionally, Upgrade provides a unique feature called "Upgrade Rewards," where borrowers can earn rewards for making on-time payments, further incentivizing responsible financial behavior.

The Application Process

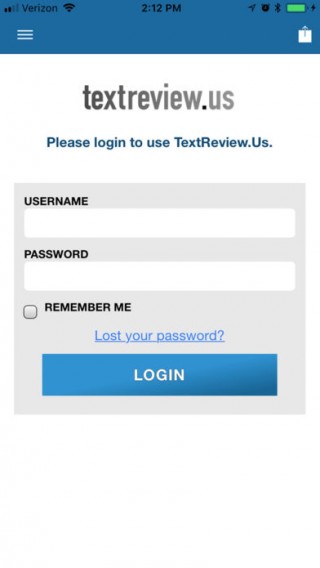

Applying for an Upgrade personal loan is straightforward and can be done entirely online. The process typically takes just a few minutes, and you’ll receive a decision within seconds. Upgrade performs a soft credit check during the pre-qualification process, allowing you to see your potential loan terms without impacting your credit score.

Once approved, you can review your loan options, including the amount, interest rate, and repayment terms. If you accept the offer, funds can be deposited into your bank account as soon as the next business day, providing quick access to cash when you need it most.

Pros and Cons of Upgrade Personal Loans

As with any financial product, it’s essential to weigh the pros and cons.

**Pros:**

- Competitive interest rates

- Flexible loan amounts and repayment terms

- Quick and easy online application process

- Upgrade Rewards program for on-time payments

**Cons:**

- Higher interest rates for borrowers with poor credit

- Limited availability in some states

Who Should Consider Upgrade Personal Loans?

Upgrade personal loans are ideal for individuals looking for a straightforward and flexible borrowing solution. Whether you’re consolidating high-interest debt, financing a home improvement project, or covering medical expenses, Upgrade offers a viable option. However, if you have a poor credit score, you may want to explore other alternatives or work on improving your credit before applying.

Final Thoughts

In conclusion, our Upgrade Personal Loan Review highlights a compelling option for those in need of financial assistance. With its competitive rates, flexible terms, and user-friendly platform, Upgrade stands out in the crowded personal loan market. If you’re ready to take control of your finances, consider exploring Upgrade’s offerings as a potential solution to meet your borrowing needs. Always remember to assess your financial situation and choose a loan that aligns with your long-term goals.