Unlocking Financial Opportunities: A Comprehensive Guide to Texas Loan Star

### IntroductionIn the vast landscape of financial solutions, **Texas Loan Star** stands out as a beacon of hope for many seeking assistance. This innovativ……

### Introduction

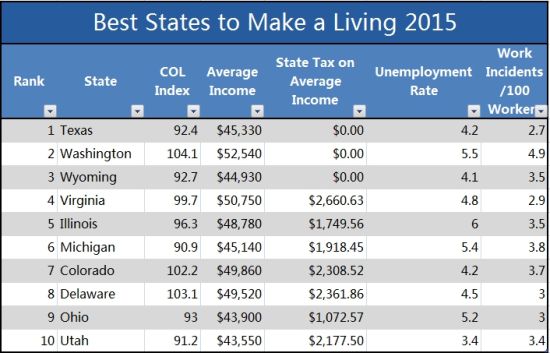

In the vast landscape of financial solutions, **Texas Loan Star** stands out as a beacon of hope for many seeking assistance. This innovative lending program provides a pathway for individuals and businesses in Texas to secure the funds they need for various purposes. Whether it's for home improvement, education, or starting a new venture, understanding the nuances of the Texas Loan Star program can open doors to new opportunities.

### What is Texas Loan Star?

**Texas Loan Star** is a state-sponsored initiative designed to offer affordable loans to residents and businesses in Texas. The program aims to stimulate economic growth and provide financial support to those who may not qualify for traditional loans. With competitive interest rates and flexible repayment options, Texas Loan Star is tailored to meet the diverse needs of its borrowers.

### Benefits of Texas Loan Star

1. **Affordable Interest Rates**: One of the standout features of Texas Loan Star is its competitive interest rates. Borrowers can access funds without the burden of exorbitant costs, making it a viable option for those on a tight budget.

2. **Flexible Repayment Terms**: The program offers various repayment plans, allowing borrowers to choose an option that best fits their financial situation. This flexibility can ease the stress of monthly payments and help borrowers manage their finances more effectively.

3. **Support for Various Purposes**: Whether you're looking to renovate your home, invest in education, or expand your business, Texas Loan Star caters to a wide range of financial needs. This versatility makes it an attractive option for many Texans.

4. **Accessible to Many**: Texas Loan Star is designed to be inclusive, providing opportunities for individuals and businesses that may have been overlooked by traditional lenders. This accessibility can empower many to pursue their goals without financial constraints.

### How to Apply for Texas Loan Star

Applying for a Texas Loan Star is a straightforward process. Here’s a step-by-step guide to help you navigate the application:

1. **Research**: Begin by researching the specific loan options available under the Texas Loan Star program. Understanding the different types of loans and their requirements will help you make an informed decision.

2. **Gather Documentation**: Prepare the necessary documents, including proof of income, identification, and any other required paperwork. Having these ready will streamline the application process.

3. **Submit Your Application**: Once you have all your documents in order, submit your application through the Texas Loan Star website or at a designated financial institution. Ensure that all information is accurate to avoid delays.

4. **Await Approval**: After submission, your application will be reviewed. If approved, you will receive details about your loan amount, interest rate, and repayment terms.

5. **Receive Funds**: Upon acceptance of the loan offer, the funds will be disbursed to you, allowing you to pursue your financial goals.

### Conclusion

In conclusion, **Texas Loan Star** is a valuable resource for Texans looking to secure financial assistance. With its affordable rates, flexible terms, and accessibility, this program has the potential to transform lives and stimulate economic growth. By understanding the benefits and application process, you can take the first step towards unlocking new financial opportunities in the Lone Star State. Whether you're a homeowner, student, or entrepreneur, Texas Loan Star could be the key to achieving your dreams.