Master Your Finances with a Comprehensive Loan Amortisation Table Excel

---### Description:In today's fast-paced financial world, understanding how to manage your loans effectively is essential for maintaining a healthy financia……

---

### Description:

In today's fast-paced financial world, understanding how to manage your loans effectively is essential for maintaining a healthy financial status. One of the most powerful tools available for this purpose is a loan amortisation table excel. This tool not only helps you track your loan repayments but also provides a clear overview of how your payments are distributed over time. In this article, we will delve into the importance of a loan amortisation table excel, how to create one, and the benefits it offers to individuals and businesses alike.

#### What is a Loan Amortisation Table?

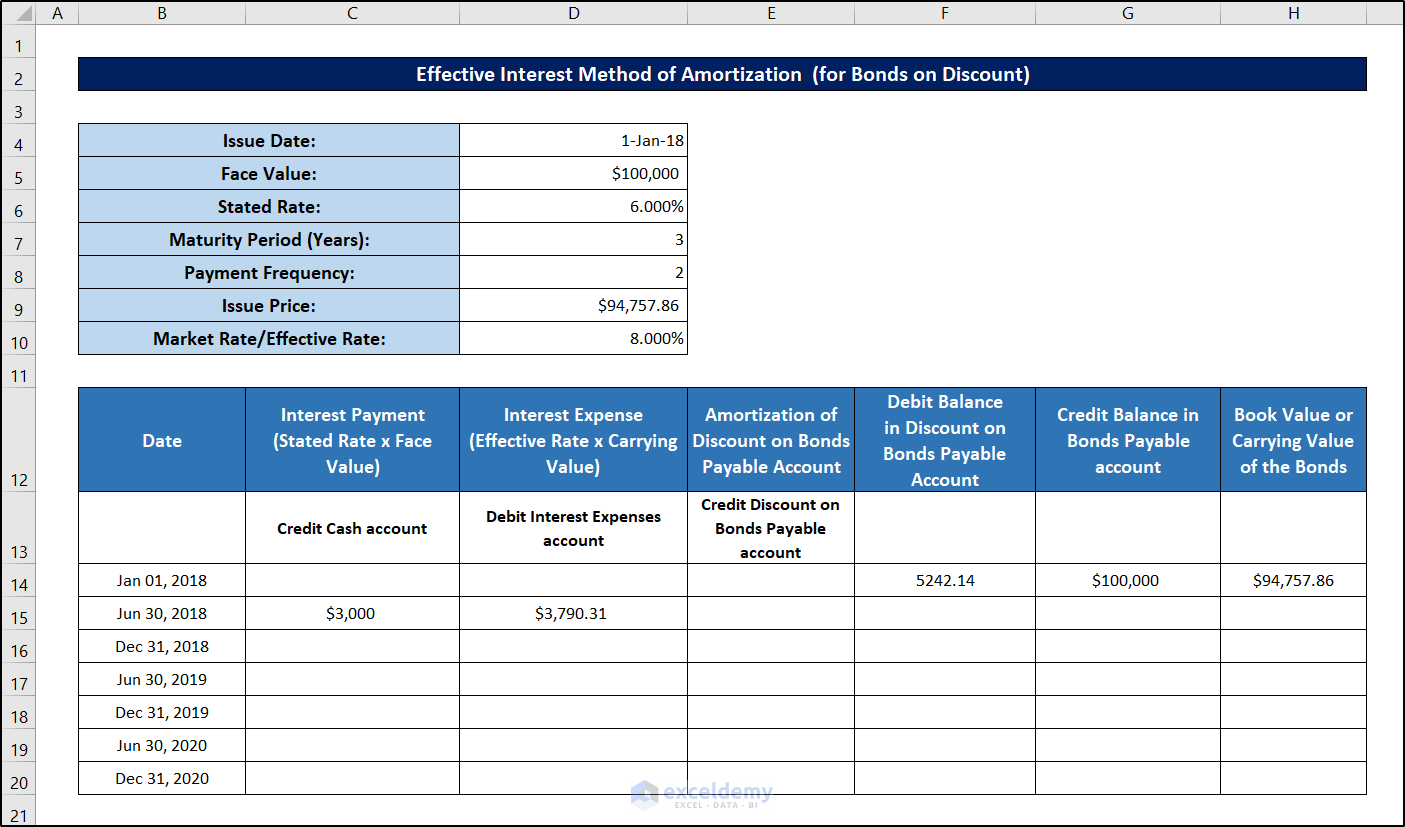

A loan amortisation table is a detailed schedule that outlines each payment made on a loan, breaking down how much of each payment goes towards the principal and how much goes towards interest. This table is particularly useful for loans with fixed interest rates, such as mortgages, car loans, and personal loans. By using a loan amortisation table excel, borrowers can visualize their repayment plan and understand the long-term implications of their borrowing decisions.

#### Key Components of a Loan Amortisation Table

1. **Payment Number**: This column indicates the sequence of payments made throughout the loan term.

2. **Payment Amount**: The total amount paid in each installment, which remains constant for fixed-rate loans.

3. **Interest Payment**: This portion of the payment goes towards interest accrued on the remaining loan balance.

4. **Principal Payment**: The amount that is applied to reduce the remaining principal balance of the loan.

5. **Remaining Balance**: After each payment, this column shows the outstanding balance of the loan, which decreases over time as payments are made.

#### Creating a Loan Amortisation Table in Excel

Creating a loan amortisation table excel is a straightforward process that can be accomplished in just a few steps:

1. **Open Excel**: Start by launching Microsoft Excel or any compatible spreadsheet software.

2. **Set Up Your Columns**: Create columns for Payment Number, Payment Amount, Interest Payment, Principal Payment, and Remaining Balance.

3. **Input Loan Details**: Enter the loan amount, interest rate, and loan term. You can calculate the monthly payment using Excel’s PMT function: `=PMT(rate, nper, pv)`, where rate is the monthly interest rate, nper is the total number of payments, and pv is the present value (loan amount).

4. **Fill in the Table**: Use formulas to calculate the Interest Payment, Principal Payment, and Remaining Balance for each row.

5. **Format the Table**: Make your table visually appealing by applying cell formatting, such as currency and borders, to enhance readability.

#### Benefits of Using a Loan Amortisation Table in Excel

1. **Enhanced Financial Awareness**: A loan amortisation table excel provides a clear picture of how your loan works. By understanding how much of your payment is going towards interest versus principal, you can make informed financial decisions.

2. **Budgeting Assistance**: Knowing your monthly payment obligations helps in budgeting and financial planning. You can anticipate when your loan will be paid off and plan for future expenses accordingly.

3. **Early Repayment Planning**: If you have extra funds available, a loan amortisation table allows you to see the impact of making additional payments towards your principal. This can significantly reduce your interest payments over the life of the loan.

4. **Comparison of Loan Options**: If you’re considering multiple loan offers, creating amortisation tables for each option can help you compare total costs and make the best financial decision.

5. **Customization**: Excel allows for easy customization of your amortisation table. You can adjust interest rates, payment frequencies, and loan terms to see how these changes affect your repayment schedule.

In conclusion, utilizing a loan amortisation table excel is a vital step towards mastering your financial commitments. It enhances your understanding of loan dynamics, aids in effective budgeting, and empowers you to make strategic decisions regarding your borrowing. Whether you are an individual managing personal loans or a business navigating complex financing options, a loan amortisation table can be an invaluable asset in your financial toolkit. Start creating your own today and take control of your financial future!