Loan Agreement Contract Sample: A Comprehensive Guide to Securing Your Finances

Guide or Summary:Key Components of a Loan Agreement Contract SampleNegotiating Favorable TermsIn the ever-evolving landscape of personal finance, obtaining……

Guide or Summary:

In the ever-evolving landscape of personal finance, obtaining a loan can be a significant milestone. Whether you're looking to purchase a home, start a business, or finance an education, a loan agreement contract is the cornerstone of this transaction. This document not only establishes the terms and conditions of the loan but also serves as a legal binding agreement between the lender and the borrower. A well-drafted loan agreement contract sample is invaluable in ensuring that both parties are fully aware of their obligations and rights.

This comprehensive guide delves into the intricacies of a loan agreement contract sample, highlighting its importance and how to effectively utilize it. From understanding the key components to negotiating favorable terms, this guide equips you with the knowledge needed to secure your finances.

Key Components of a Loan Agreement Contract Sample

A loan agreement contract sample typically encompasses several critical components, each serving a specific purpose in safeguarding the interests of both parties. These components include:

1. **Loan Details**: This section outlines the principal amount, interest rate, and repayment terms. It's crucial to ensure that all loan details are accurate and transparent.

2. **Security and Collateral**: This section details any collateral or security required to secure the loan. Understanding the value and impact of collateral is essential in minimizing risk for both parties.

3. **Repayment Schedule**: A detailed repayment schedule is essential for both the lender and the borrower. It outlines the frequency and amount of repayments, ensuring that both parties are aware of their financial obligations.

4. **Penalties and Default Terms**: This section outlines the consequences of defaulting on the loan. Understanding these terms is vital in avoiding unnecessary financial penalties.

5. **Dispute Resolution**: This section outlines the process for resolving any disputes that may arise during the loan term. Having a clear dispute resolution mechanism is crucial in maintaining a harmonious relationship between the lender and the borrower.

Negotiating Favorable Terms

While a loan agreement contract sample provides a solid foundation, the ability to negotiate favorable terms can significantly impact your financial well-being. Here are some tips for negotiating effectively:

1. **Understand Your Financial Position**: Knowing your financial capabilities and limitations is crucial in determining the terms that are most suitable for you. This includes your income, expenses, and overall financial stability.

2. **Research Loan Options**: Before finalizing a loan agreement, research different loan options available in the market. This includes understanding the interest rates, repayment terms, and any available discounts or incentives.

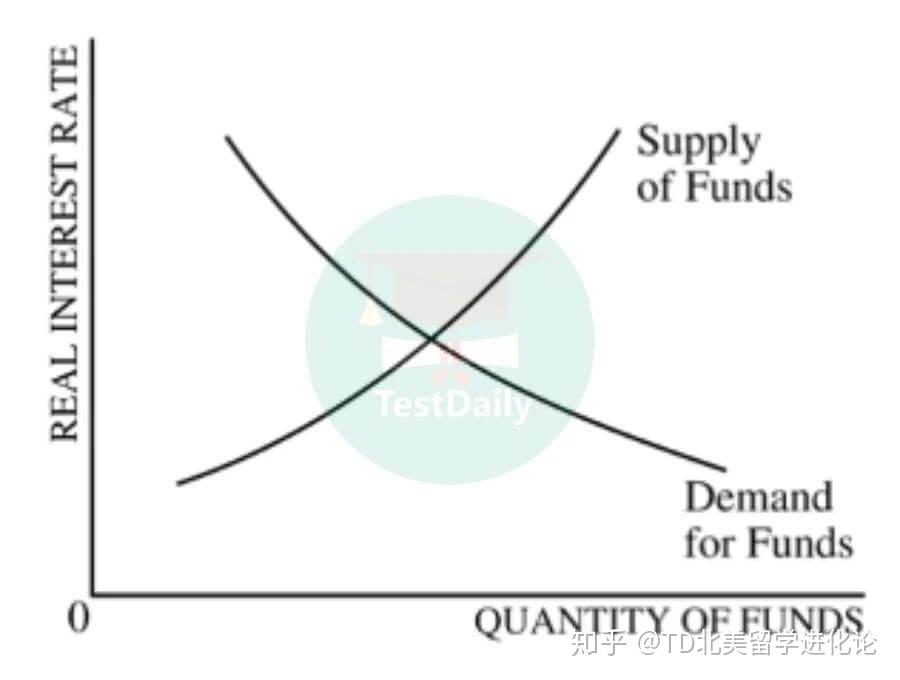

3. **Negotiate Interest Rates**: Interest rates can significantly impact the overall cost of your loan. Be prepared to negotiate and present your financial situation to the lender to secure a favorable interest rate.

4. **Discuss Repayment Terms**: Repayment terms, including the frequency and amount of payments, can be negotiated to fit your financial situation. This may include extending the repayment period or reducing monthly payments.

5. **Review and Understand the Agreement**: Before signing a loan agreement, thoroughly review and understand all terms and conditions. This includes any penalties, default terms, and dispute resolution mechanisms.

In conclusion, a loan agreement contract sample is a crucial document in securing your finances. By understanding its key components and negotiating favorable terms, you can ensure a successful and beneficial loan agreement. Remember, knowledge is power, and taking the time to educate yourself on this matter can lead to significant financial benefits.