Unlocking Prosperity: The Strategic Guide to Boosting Your Bank Loan Business

Guide or Summary:Market Research and Customer SegmentationProduct Development and InnovationEffective Risk ManagementStreamlined Loan Application ProcessesE……

Guide or Summary:

- Market Research and Customer Segmentation

- Product Development and Innovation

- Effective Risk Management

- Streamlined Loan Application Processes

- Enhancing Customer Service and Relationship Management

- Leveraging Digital Marketing and Social Media

- Regulatory Compliance and Ethical Practices

When it comes to financing growth and expansion, the bank loan business stands as a cornerstone of financial stability. However, amidst the competitive landscape, excelling in this sector requires not just a keen understanding of financial products but also a strategic approach to marketing, risk management, and customer service. In this comprehensive guide, we delve into the multifaceted world of bank loan businesses, offering actionable insights to help you navigate the complexities of the industry and carve out a successful niche.

Market Research and Customer Segmentation

Understanding your target market is the first step towards building a thriving bank loan business. Conducting thorough market research allows you to identify the specific needs and preferences of your potential customers. By segmenting your market based on factors such as income level, credit history, and business type, you can tailor your loan offerings to meet the diverse needs of your clientele.

Product Development and Innovation

In the realm of bank loans, constant innovation is key to staying ahead of the competition. Offering a variety of loan products that cater to different business needs can attract a wider customer base. From traditional business loans to innovative solutions like lines of credit or working capital loans, diversifying your product portfolio can enhance customer satisfaction and loyalty.

Effective Risk Management

Managing risk is a critical aspect of the bank loan business. Implementing robust risk assessment tools and strategies can help mitigate potential losses and protect your business's financial health. This includes thorough credit checks, collateral evaluation, and the development of a comprehensive risk management plan that addresses various scenarios and contingencies.

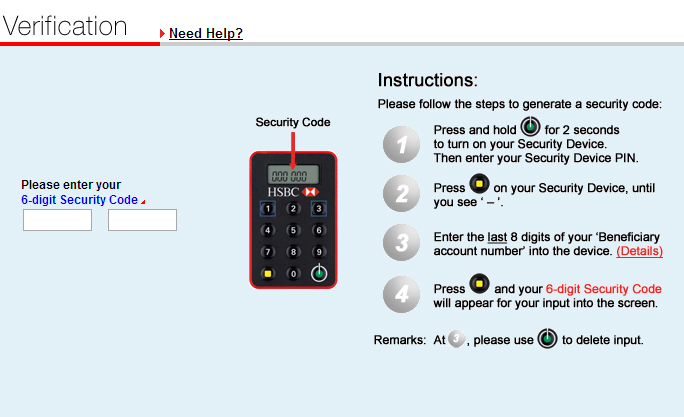

Streamlined Loan Application Processes

A user-friendly loan application process is essential in today's fast-paced business environment. By adopting a streamlined approach that minimizes paperwork and leverages technology, you can significantly reduce the time and effort required for loan approval. This not only enhances customer satisfaction but also helps in attracting new clients who appreciate efficiency and transparency in the loan application process.

Enhancing Customer Service and Relationship Management

Building strong relationships with your customers is paramount in the bank loan business. Providing excellent customer service, including prompt responses to inquiries, personalized loan advice, and ongoing support, can foster trust and loyalty. Regular communication and feedback mechanisms can help you understand your customers' needs better and continuously improve your services to meet their evolving expectations.

Leveraging Digital Marketing and Social Media

In the digital age, leveraging online platforms and social media can significantly enhance your bank loan business's visibility and reach. Developing a strong online presence through informative content, engaging social media campaigns, and strategic search engine optimization (SEO) efforts can attract potential clients and establish your brand as a trusted financial partner. Engaging with your audience through regular updates and interactive content can also build a loyal following and drive referrals.

Regulatory Compliance and Ethical Practices

Adhering to regulatory standards and practicing ethical business conduct is non-negotiable in the bank loan industry. Staying informed about the latest regulations and ensuring your business practices align with ethical standards can protect your reputation and build customer trust. This includes transparent pricing, fair lending practices, and prompt resolution of any customer complaints or disputes.

In conclusion, the bank loan business offers immense opportunities for growth and profitability. By adopting a strategic approach that emphasizes market research, product innovation, risk management, customer service, and digital marketing, you can build a robust and profitable bank loan business. Remember, the key to success lies in understanding your customers' needs, continuously improving your offerings, and maintaining the highest standards of professionalism and ethics. With these principles in mind, you're well on your way to unlocking prosperity in the bank loan business.