Mortgage Loan Calculator Florida: A Comprehensive Tool for Homebuyers

Guide or Summary:Mortgage Loan Calculator Florida: Simplifying the Mortgage ProcessCustomizing Your Mortgage Loan Calculator Florida ExperienceUnderstanding……

Guide or Summary:

- Mortgage Loan Calculator Florida: Simplifying the Mortgage Process

- Customizing Your Mortgage Loan Calculator Florida Experience

- Understanding the Impact of Mortgage Loan Calculator Florida

- Why Choose the Mortgage Loan Calculator Florida?

In the bustling state of Florida, purchasing a home is not just a dream but a reality for many. With its vibrant cities, pristine beaches, and diverse communities, Florida offers a unique blend of lifestyle and property options. However, navigating the complexities of mortgage loans can be daunting, especially for first-time homebuyers. This is where the Mortgage Loan Calculator Florida comes into play, offering a comprehensive tool designed to simplify the process and empower homebuyers with the knowledge they need to make informed decisions.

Mortgage Loan Calculator Florida: Simplifying the Mortgage Process

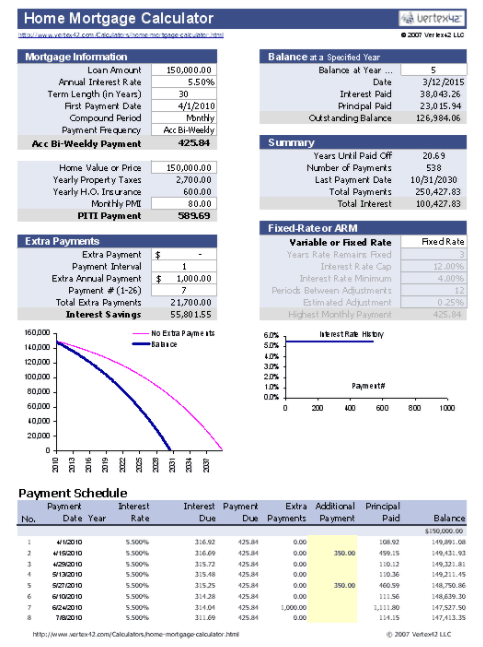

The Mortgage Loan Calculator Florida is a user-friendly tool that streamlines the mortgage loan process, making it accessible to everyone, regardless of their financial expertise. By inputting key details such as the loan amount, interest rate, and repayment term, users can quickly calculate their monthly mortgage payments and understand the total cost over the life of the loan. This transparency is crucial for budgeting and financial planning, enabling homebuyers to assess the affordability of their desired property.

Customizing Your Mortgage Loan Calculator Florida Experience

One of the standout features of the Mortgage Loan Calculator Florida is its customization options. Homebuyers can adjust various parameters to explore different mortgage scenarios, such as varying loan terms, interest rates, and down payment amounts. This flexibility allows users to find the most suitable mortgage option that aligns with their financial goals and risk tolerance. Whether you're looking for a fixed-rate mortgage or a flexible adjustable-rate mortgage, the Mortgage Loan Calculator Florida provides a tailored approach to mortgage planning.

Understanding the Impact of Mortgage Loan Calculator Florida

The Mortgage Loan Calculator Florida is not just a tool for calculating monthly payments; it serves as an educational resource for homebuyers. By understanding the impact of different variables on their mortgage payments, users can make informed decisions about their home purchase. For instance, increasing the down payment can reduce the monthly payments and the overall interest paid over the life of the loan. Similarly, choosing a shorter repayment term can lower the interest paid but increase the monthly payments. The Mortgage Loan Calculator Florida helps demystify these financial implications, empowering homebuyers to take control of their mortgage decisions.

Why Choose the Mortgage Loan Calculator Florida?

The Mortgage Loan Calculator Florida stands out from other mortgage calculators available in the market due to its simplicity, customization, and educational value. It is designed with the user in mind, offering an intuitive interface that is easy to navigate, even for those with limited financial knowledge. Furthermore, the Mortgage Loan Calculator Florida is regularly updated to reflect the latest mortgage rates and loan products, ensuring that users have access to the most current information.

In conclusion, the Mortgage Loan Calculator Florida is an invaluable resource for homebuyers in Florida. By simplifying the mortgage loan process, providing customization options, and offering educational insights, it empowers users to make informed decisions about their home purchase. Whether you're a first-time homebuyer or an experienced investor, the Mortgage Loan Calculator Florida is your go-to tool for navigating the complexities of mortgage loans in the Sunshine State.