Understanding High Balance Loan Limits 2024 California: What Homebuyers Need to Know

#### High Balance Loan Limits 2024 CaliforniaAs we approach 2024, it's essential for homebuyers and real estate professionals in California to understand th……

#### High Balance Loan Limits 2024 California

As we approach 2024, it's essential for homebuyers and real estate professionals in California to understand the implications of high balance loan limits 2024 California. These limits are crucial for those looking to secure financing for homes in higher-cost areas, where standard conforming loan limits may not suffice.

The Federal Housing Finance Agency (FHFA) sets the conforming loan limits annually, and for 2024, California's high balance loan limits are expected to be adjusted to reflect the rising home prices in many regions. Understanding these limits can significantly impact your home buying strategy, especially if you're in a competitive market.

#### Why High Balance Loan Limits Matter

High balance loans, often referred to as jumbo loans, allow buyers to finance properties that exceed the conventional loan limits set by Fannie Mae and Freddie Mac. In California, where the cost of living is notably high, the high balance loan limits 2024 California are particularly relevant. These loans can be a lifeline for buyers looking to purchase homes in desirable neighborhoods where prices are frequently above the national average.

For instance, if you're looking to buy a home in areas like San Francisco, Los Angeles, or San Diego, understanding the specific high balance loan limits can help you determine your budget and financing options. It’s important to note that these loans typically come with stricter credit requirements and higher interest rates, so buyers should be prepared for a more rigorous application process.

#### Impact of Market Trends on Loan Limits

As we move into 2024, it's crucial to keep an eye on market trends that could influence high balance loan limits 2024 California. The real estate market in California has been characterized by fluctuating prices, and various economic factors, including interest rates and inflation, play a significant role in shaping these limits.

For example, if home prices continue to rise, the FHFA may increase the high balance loan limits to accommodate the changing market. This would allow more buyers to qualify for loans that enable them to purchase homes without exceeding the limits set for conventional financing. Conversely, if the market experiences a downturn, these limits may remain stagnant or even decrease, affecting buyer purchasing power.

#### Preparing for 2024: What Buyers Should Do

As a prospective homebuyer in California, it’s essential to prepare for the upcoming changes in high balance loan limits 2024 California. Here are a few tips to help you navigate the process:

1. **Stay Informed**: Keep an eye on announcements from the FHFA regarding the new loan limits for 2024. Understanding these changes can help you strategize your home purchase effectively.

2. **Assess Your Financial Situation**: Before applying for a high balance loan, evaluate your credit score, debt-to-income ratio, and overall financial health. This will give you a clearer picture of what you can afford and whether you qualify for a high balance loan.

3. **Work with a Mortgage Professional**: Collaborating with a knowledgeable mortgage broker or lender can provide you with insights into the best financing options available to you, including understanding the nuances of high balance loans.

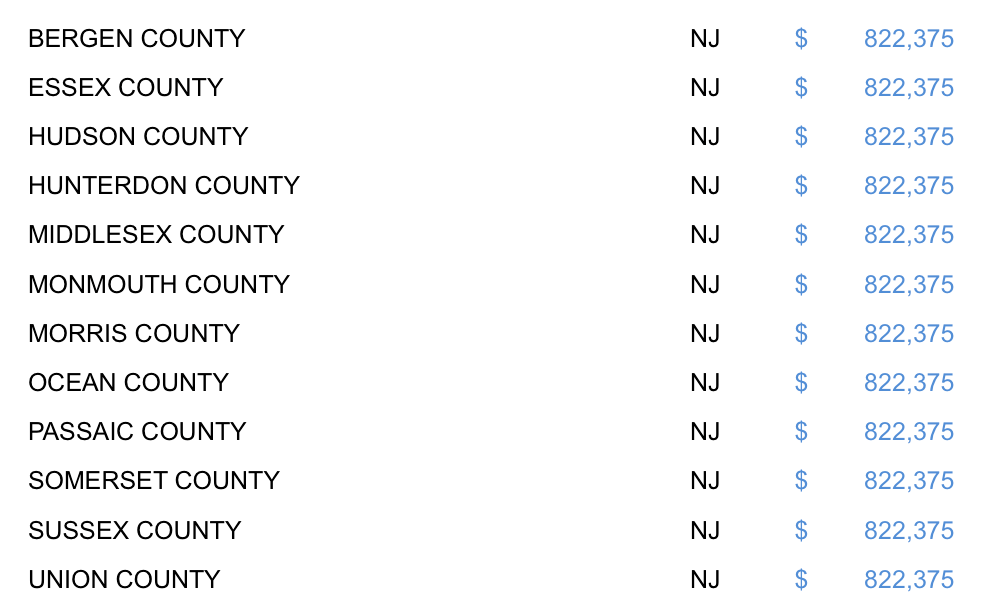

4. **Consider Your Location**: Different areas in California may have varying high balance loan limits. Research the specific limits for the area you are interested in to ensure you are making informed decisions.

In conclusion, understanding the high balance loan limits 2024 California is vital for anyone looking to navigate the California real estate market effectively. By staying informed and preparing adequately, you can position yourself for success in the competitive housing landscape of 2024.