"Understanding Home Equity Loan Rates Fixed: A Comprehensive Guide to Securing Your Financial Future"

#### Home Equity Loan Rates FixedHome equity loans are a popular financial product that allows homeowners to borrow against the equity they have built up in……

#### Home Equity Loan Rates Fixed

Home equity loans are a popular financial product that allows homeowners to borrow against the equity they have built up in their property. One of the key aspects to consider when looking into home equity loans is the interest rate, particularly the fixed rates. In this article, we will explore what home equity loan rates fixed mean, how they work, and what factors can influence them.

#### What Are Home Equity Loan Rates Fixed?

Home equity loan rates fixed refer to the interest rates that remain unchanged throughout the life of the loan. This means that borrowers can enjoy predictable monthly payments, making it easier to budget and plan for the future. Unlike variable-rate loans, where interest rates can fluctuate based on market conditions, fixed-rate home equity loans provide stability and peace of mind.

#### How Do Home Equity Loans Work?

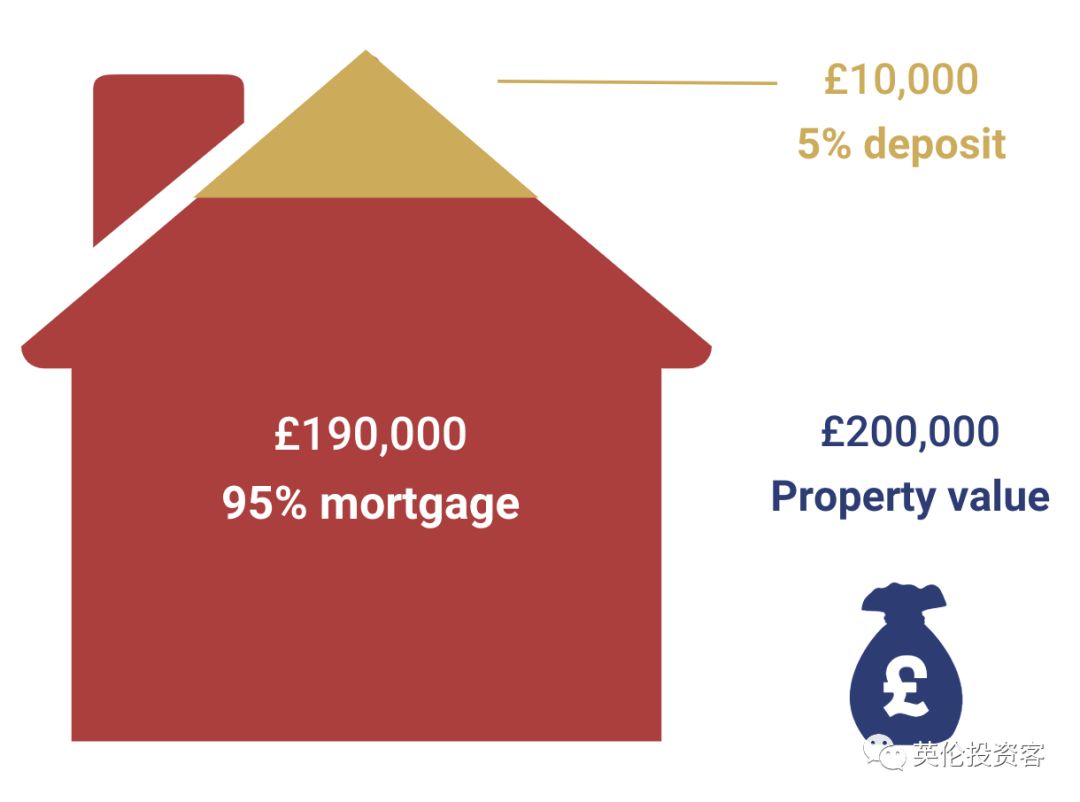

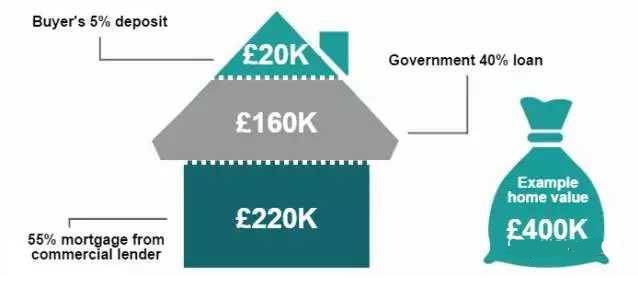

When you take out a home equity loan, you are essentially borrowing money against the value of your home. The amount you can borrow typically depends on the equity you have in your property, which is calculated by subtracting any outstanding mortgage balance from the current market value of your home. For example, if your home is worth $300,000 and you owe $200,000 on your mortgage, you have $100,000 in equity.

Home equity loans are often used for significant expenses, such as home renovations, debt consolidation, or education costs. Because these loans are secured by your home, they usually come with lower interest rates compared to unsecured loans or credit cards.

#### Factors Influencing Home Equity Loan Rates Fixed

Several factors can influence the fixed interest rates for home equity loans:

1. **Credit Score**: Lenders typically offer better rates to borrowers with higher credit scores. A good credit score demonstrates a history of responsible borrowing and repayment, making you a less risky investment for lenders.

2. **Loan-to-Value Ratio (LTV)**: This ratio compares the amount of your loan to the appraised value of your home. A lower LTV indicates less risk for the lender, which can result in more favorable rates.

3. **Market Conditions**: Interest rates can be influenced by broader economic factors, including inflation, the Federal Reserve's monetary policy, and overall demand for loans. Keeping an eye on these trends can help you time your loan application for the best rates.

4. **Loan Amount and Term**: The amount you wish to borrow and the length of the loan can also affect your interest rate. Generally, smaller loans or shorter terms may come with higher rates, while larger loans or longer terms might offer lower rates.

#### Benefits of Choosing Home Equity Loan Rates Fixed

Opting for fixed rates on home equity loans comes with several advantages:

- **Predictability**: With fixed rates, you know exactly how much you will pay each month, making it easier to manage your finances.

- **Protection Against Rate Increases**: If market interest rates rise, your fixed rate will remain the same, potentially saving you money over the life of the loan.

- **Long-Term Planning**: Fixed rates allow for better long-term financial planning since you can anticipate your monthly obligations without worrying about fluctuations.

#### Conclusion

In summary, understanding home equity loan rates fixed is crucial for homeowners looking to leverage their property’s equity for financial needs. By considering factors like credit score, LTV, and market conditions, you can find the best rates available. Fixed-rate home equity loans provide stability and predictability, making them an attractive option for many borrowers. As you navigate your financial journey, being informed about your options can lead to better decision-making and a more secure financial future.