Exploring Home Equity Loan Rates in Arkansas: Your Comprehensive Guide

Guide or Summary:What Are Home Equity Loans?Current Home Equity Loan Rates in ArkansasFactors Affecting Home Equity Loan RatesBenefits of Home Equity LoansH……

Guide or Summary:

- What Are Home Equity Loans?

- Current Home Equity Loan Rates in Arkansas

- Factors Affecting Home Equity Loan Rates

- Benefits of Home Equity Loans

- How to Get the Best Home Equity Loan Rates in Arkansas

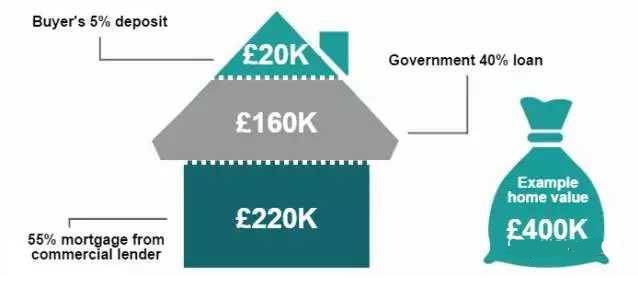

When considering financing options, many homeowners in Arkansas are turning to home equity loans as a viable solution. Understanding the intricacies of home equity loan rates Arkansas is essential for making informed financial decisions. A home equity loan allows you to borrow against the equity you have built in your home, providing you with a lump sum of cash that can be used for various purposes, such as home improvements, debt consolidation, or major purchases.

What Are Home Equity Loans?

Home equity loans are secured loans that use your home as collateral. This means that the amount you can borrow is typically based on the difference between your home's current market value and the outstanding balance on your mortgage. The interest rates for these loans can vary significantly based on several factors, including your credit score, the amount of equity you have in your home, and the lender's policies.

Current Home Equity Loan Rates in Arkansas

As of now, the home equity loan rates Arkansas are influenced by the broader economic environment, including federal interest rates and local market conditions. Rates can fluctuate, so it's crucial to shop around and compare offers from different lenders. Typically, rates can range from 3% to 8% or more, depending on your financial profile and the lender you choose.

Factors Affecting Home Equity Loan Rates

Several factors can impact the rates you receive for a home equity loan in Arkansas:

1. **Credit Score**: Lenders use your credit score to assess your creditworthiness. A higher score can lead to lower interest rates.

2. **Loan-to-Value Ratio (LTV)**: This ratio compares the loan amount to the appraised value of your home. A lower LTV can result in better rates.

3. **Debt-to-Income Ratio (DTI)**: Lenders also consider your DTI, which measures your monthly debt payments against your income. A lower DTI can improve your chances of securing a favorable rate.

4. **Market Conditions**: Economic factors, such as inflation and changes in the Federal Reserve's interest rates, can influence the overall lending environment.

Benefits of Home Equity Loans

Home equity loans come with several benefits:

- **Lower Interest Rates**: Compared to unsecured loans, home equity loans often have lower interest rates since they are secured by your home.

- **Fixed Interest Rates**: Many home equity loans offer fixed rates, providing predictability in your monthly payments.

- **Tax Benefits**: In some cases, the interest on home equity loans may be tax-deductible, making them a more attractive option for financing.

How to Get the Best Home Equity Loan Rates in Arkansas

To secure the best home equity loan rates Arkansas, consider the following steps:

1. **Improve Your Credit Score**: Pay down debts and ensure your credit report is accurate.

2. **Shop Around**: Compare rates from multiple lenders, including banks, credit unions, and online lenders.

3. **Negotiate**: Don't hesitate to negotiate terms with lenders or ask for better rates based on your financial profile.

4. **Understand the Fees**: Be aware of any closing costs or fees associated with the loan, as these can impact your overall borrowing costs.

In conclusion, understanding home equity loan rates Arkansas is crucial for homeowners looking to leverage their home equity for financial needs. By considering the factors that affect these rates and taking steps to improve your financial standing, you can find a loan that meets your needs while minimizing costs. Whether you're looking to renovate your home, consolidate debt, or fund a major purchase, a home equity loan could be a strategic financial move.