Comprehensive Loans Review: Your Ultimate Guide to Choosing the Right Loan

#### Loans ReviewIn today’s financial landscape, understanding the various loan options available is crucial for making informed decisions. This **loans rev……

#### Loans Review

In today’s financial landscape, understanding the various loan options available is crucial for making informed decisions. This **loans review** aims to dissect different types of loans, their pros and cons, and provide insights to help you choose the best option for your financial needs.

#### Types of Loans

When it comes to borrowing money, there are several types of loans available. Here are the most common categories you will encounter:

1. **Personal Loans**: These are unsecured loans that can be used for a variety of purposes, from consolidating debt to financing a vacation. Personal loans typically have higher interest rates compared to secured loans because they are not backed by collateral.

2. **Mortgage Loans**: If you’re looking to buy a home, a mortgage loan is likely the best option. These loans are secured by the property itself, which means that if you fail to make payments, the lender can take possession of your home. Mortgages usually come with lower interest rates and longer repayment terms.

3. **Auto Loans**: Designed specifically for purchasing vehicles, auto loans can be secured or unsecured. Secured auto loans use the vehicle as collateral, which often results in lower interest rates. However, if you default, the lender can repossess the car.

4. **Student Loans**: These loans are intended to help students pay for their education. They can be federal or private, with federal loans generally offering lower interest rates and more flexible repayment options.

5. **Business Loans**: For entrepreneurs looking to start or expand their businesses, business loans provide the necessary capital. These can be secured by business assets or unsecured, depending on the lender’s requirements.

#### Factors to Consider in a Loans Review

When conducting a **loans review**, several factors should be taken into account to ensure you select the right loan:

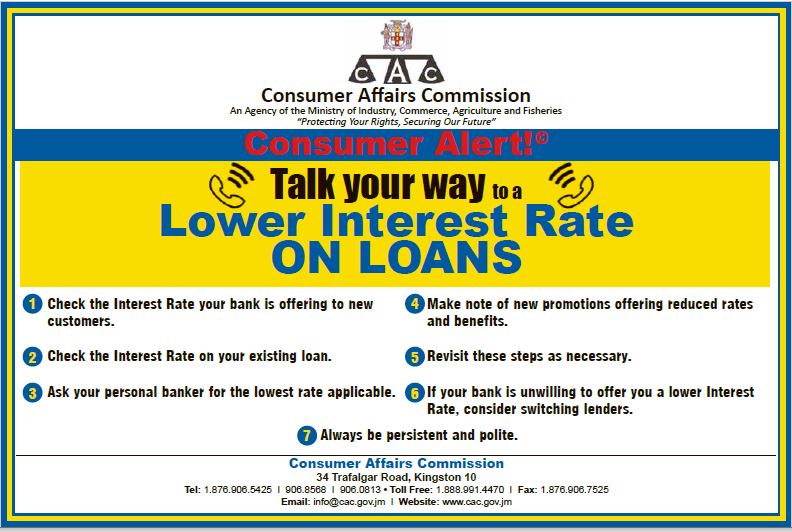

- **Interest Rates**: The cost of borrowing money is primarily determined by the interest rate. It’s essential to compare rates from different lenders to find the most favorable terms.

- **Loan Terms**: The length of time you have to repay the loan can significantly affect your monthly payments and the total interest paid over the life of the loan. Shorter terms typically mean higher monthly payments but less interest overall.

- **Fees**: Many loans come with associated fees, such as origination fees, closing costs, and prepayment penalties. Make sure to factor these into your overall cost when evaluating loan options.

- **Credit Score**: Your credit score plays a crucial role in determining the interest rates and terms you’ll qualify for. A higher credit score usually results in better loan conditions.

- **Lender Reputation**: Researching the lender’s reputation is vital. Look for reviews and ratings from other borrowers to gauge the lender’s customer service and reliability.

#### Conclusion

A thorough **loans review** is essential for anyone considering borrowing money. By understanding the various types of loans available and the factors that influence loan decisions, you can make a more informed choice that aligns with your financial goals. Whether you are looking for a personal loan, mortgage, auto loan, student loan, or business loan, taking the time to research and compare your options will ultimately save you money and stress in the long run. Always remember to read the fine print and consult with financial advisors if necessary to ensure you’re making the best choice for your unique situation.