A Comprehensive Guide on How to Apply for Student Loan Forgiveness Application: Step-by-Step Instructions and Tips

#### How to apply for student loan forgiveness applicationStudent loan forgiveness programs have become a beacon of hope for many borrowers struggling with……

#### How to apply for student loan forgiveness application

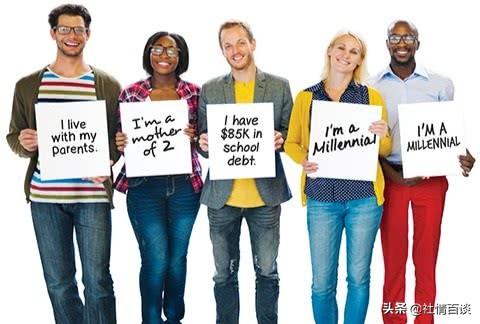

Student loan forgiveness programs have become a beacon of hope for many borrowers struggling with their educational debt. If you're looking to alleviate your financial burden, understanding how to apply for student loan forgiveness application is crucial. This guide will walk you through the entire process, providing essential tips and detailed steps to ensure your application is successful.

#### Understanding Student Loan Forgiveness

Before diving into the application process, it’s important to understand what student loan forgiveness is. Essentially, it allows borrowers to have a portion or all of their federal student loans canceled after meeting certain criteria. Various programs exist, including Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and income-driven repayment plan forgiveness. Each program has specific eligibility requirements, so it’s vital to identify which one applies to your situation.

#### Eligibility Requirements

To apply for student loan forgiveness, you first need to determine if you qualify. For instance, the PSLF program requires borrowers to work full-time for a qualifying employer, such as a government agency or a non-profit organization, and make 120 qualifying monthly payments. On the other hand, Teacher Loan Forgiveness is aimed at educators who teach in low-income schools for five consecutive years.

#### Step-by-Step Application Process

1. **Research the Programs**: Start by researching the different forgiveness programs available. Visit the Federal Student Aid website to find detailed information about each program's requirements and benefits.

2. **Gather Necessary Documentation**: Before applying, collect all required documents, including your loan information, employment records, and any forms that demonstrate your eligibility. This may include pay stubs, tax returns, or proof of employment.

3. **Complete the Application**: For most programs, you will need to fill out specific forms. For PSLF, for example, you must submit the Employment Certification Form to verify your employment. Ensure that all information is accurate and complete to avoid delays.

4. **Submit Your Application**: After filling out the necessary forms, submit your application according to the program's guidelines. Keep a copy of everything you send for your records.

5. **Follow Up**: After submitting your application, it’s essential to follow up with your loan servicer. This ensures that your application is being processed and allows you to address any issues that may arise.

#### Tips for a Successful Application

- **Stay Organized**: Keep all documents and communications related to your student loans in one place. This will make it easier to track your progress and respond to requests for additional information.

- **Be Aware of Deadlines**: Each forgiveness program has specific deadlines. Make sure you are aware of these and submit your application on time.

- **Seek Help if Needed**: If you find the process overwhelming, consider reaching out to a financial advisor or a student loan counselor. They can provide guidance tailored to your situation.

- **Stay Informed**: The rules and regulations surrounding student loan forgiveness can change. Stay updated on any changes that may affect your eligibility or the application process.

#### Conclusion

Applying for student loan forgiveness can be a complex process, but understanding how to apply for student loan forgiveness application is the first step toward financial relief. By following the outlined steps and staying informed, you can navigate the application process with confidence. Remember, the goal is to ease your financial burden and pave the way for a brighter financial future.