Understanding the Credit Score Requirements for FHA Loans in 2023

#### Credit Score for FHA Loan 2023In 2023, securing an FHA loan can be an excellent option for first-time homebuyers and those with less-than-perfect credi……

#### Credit Score for FHA Loan 2023

In 2023, securing an FHA loan can be an excellent option for first-time homebuyers and those with less-than-perfect credit. However, understanding the credit score for FHA loan 2023 is crucial for potential borrowers. FHA loans, backed by the Federal Housing Administration, are designed to help individuals and families achieve homeownership, especially when traditional loans may be out of reach.

#### Importance of Credit Score

Your credit score is a critical factor that lenders consider when evaluating your mortgage application. For FHA loans, the minimum credit score requirement is typically 580 for those who wish to make a down payment of 3.5%. If your credit score is between 500 and 579, you may still qualify, but a larger down payment of 10% will be required. This tiered approach to credit scores allows more flexibility for borrowers with varying credit histories.

#### Factors Affecting Your Credit Score

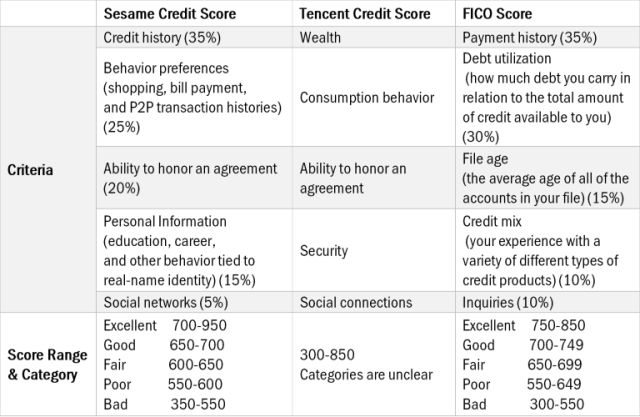

Several factors influence your credit score, including payment history, credit utilization, length of credit history, new credit inquiries, and types of credit used. To improve your credit score for FHA loan 2023, focus on paying bills on time, reducing outstanding debts, and avoiding new credit inquiries before applying for a mortgage.

#### Steps to Improve Your Credit Score

If your credit score is below the FHA minimum, there are steps you can take to improve it before applying for a loan. Start by obtaining a copy of your credit report to identify any errors or discrepancies. Dispute any inaccuracies, as they can negatively impact your score. Additionally, pay down high credit card balances and avoid opening new credit accounts in the months leading up to your application.

#### Benefits of FHA Loans

FHA loans offer several advantages, making them an attractive option for many borrowers. In addition to lower credit score requirements, they also allow for a lower down payment, flexible income requirements, and the ability to finance closing costs. These features make FHA loans particularly appealing to first-time homebuyers or those with limited savings.

#### Conclusion

Understanding the credit score for FHA loan 2023 is essential for anyone considering this type of mortgage. By knowing the requirements and taking steps to improve your credit score, you can increase your chances of approval and secure better loan terms. With the right preparation, an FHA loan can be a stepping stone toward homeownership, allowing you to build equity and invest in your future. Always consult with a mortgage professional to explore your options and find the best path to achieving your homeownership dreams in 2023.