Maximize Your Savings with the Ultimate Home Loan Amount Calculator

Guide or Summary:Understanding Home Loan Amount CalculatorThe Importance of Using a Home Loan Amount CalculatorHow to Use a Home Loan Amount CalculatorBenef……

Guide or Summary:

- Understanding Home Loan Amount Calculator

- The Importance of Using a Home Loan Amount Calculator

- How to Use a Home Loan Amount Calculator

- Benefits of Using a Home Loan Amount Calculator

- Common Mistakes to Avoid When Using a Home Loan Amount Calculator

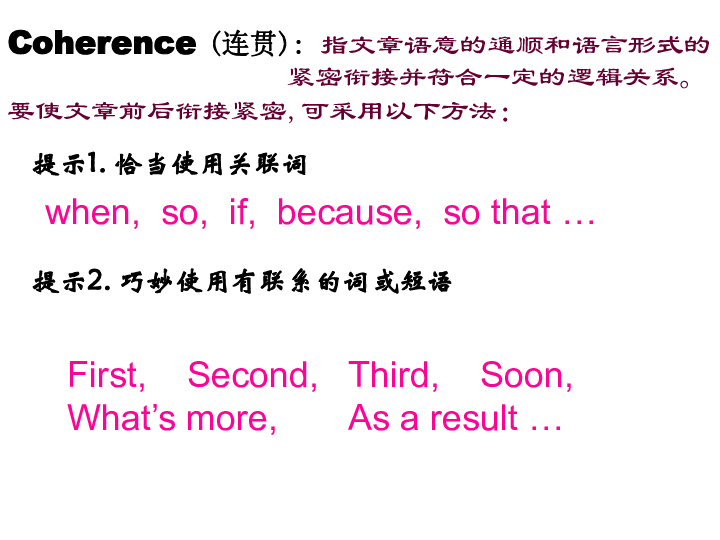

Understanding Home Loan Amount Calculator

A **home loan amount calculator** is an essential tool for anyone looking to purchase a property. It allows prospective homeowners to estimate how much they can borrow based on their financial situation. By inputting various parameters such as income, expenses, and interest rates, users can gain insights into their borrowing capacity and monthly repayments.

The Importance of Using a Home Loan Amount Calculator

Utilizing a **home loan amount calculator** can significantly impact your home buying journey. It helps you understand your budget and sets realistic expectations regarding what you can afford. By calculating potential loan amounts, you can avoid falling in love with properties that are out of your financial reach. This tool also aids in comparing different loan offers, enabling you to make informed decisions.

How to Use a Home Loan Amount Calculator

Using a **home loan amount calculator** is straightforward. Most calculators require basic information such as:

1. **Annual Income**: This includes all sources of income, which will determine your borrowing capacity.

2. **Monthly Expenses**: Regular expenses such as credit card payments, student loans, and other financial obligations are crucial for calculating your disposable income.

3. **Interest Rate**: The prevailing market interest rate will affect your monthly payments and total loan cost.

4. **Loan Term**: The duration for which you intend to take the loan, typically ranging from 15 to 30 years.

Once you input these details, the calculator will provide an estimated loan amount you can afford, along with potential monthly payments.

Benefits of Using a Home Loan Amount Calculator

1. **Clarity on Financial Limits**: A **home loan amount calculator** helps you identify your financial boundaries, allowing you to make more informed choices when house hunting.

2. **Time-Saving**: Instead of manually calculating potential loan amounts and repayments, the calculator provides instant results, saving you valuable time.

3. **Comparison of Loan Options**: By adjusting different variables like interest rates and loan terms, you can see how these changes affect your loan amount and monthly payments, enabling you to compare various loan products effectively.

4. **Budget Planning**: Understanding your borrowing capacity helps you create a realistic budget, ensuring that you can comfortably manage your mortgage payments along with other financial responsibilities.

Common Mistakes to Avoid When Using a Home Loan Amount Calculator

While a **home loan amount calculator** is a powerful tool, there are common pitfalls users should be aware of:

1. **Overestimating Income**: Be realistic about your income. Overestimating can lead to borrowing more than you can afford.

2. **Ignoring Other Costs**: Remember to factor in property taxes, insurance, and maintenance costs, which can significantly affect your budget.

3. **Not Considering Future Changes**: Consider potential changes in your financial situation, such as job changes, family growth, or economic shifts that could impact your ability to repay the loan.

In conclusion, a **home loan amount calculator** is an invaluable resource for anyone considering purchasing a home. By providing a clear picture of your borrowing capacity and monthly payments, it empowers you to make informed decisions and ultimately achieve your homeownership goals. Whether you are a first-time buyer or looking to refinance, using this tool can lead to significant savings and a smoother home buying experience. Make sure to leverage this tool effectively to navigate the complexities of home financing with confidence.