Understanding Your Rights: Can Payday Loans Take You to Court?

Guide or Summary:IntroductionThe Nature of Payday LoansCan Payday Loans Take You to Court?What Happens If You Default?Legal Protections for BorrowersPrevent……

Guide or Summary:

- Introduction

- The Nature of Payday Loans

- Can Payday Loans Take You to Court?

- What Happens If You Default?

- Legal Protections for Borrowers

- Preventing Legal Action

**Translation of "can payday loans take you to court":** Can payday loans take you to court

---

Introduction

In today's fast-paced world, many individuals find themselves in need of quick cash solutions. One popular option is payday loans, which promise fast approvals and immediate funds. However, these loans come with a host of risks and potential legal consequences. A common question arises: Can payday loans take you to court? In this article, we will explore the implications of payday loans, the legal actions lenders may pursue, and what borrowers can do to protect themselves.

The Nature of Payday Loans

Payday loans are short-term, high-interest loans typically due on the borrower’s next payday. They are designed to provide immediate financial relief but often trap borrowers in a cycle of debt due to exorbitant interest rates and fees. Understanding the terms of these loans is crucial before signing any agreement.

Can Payday Loans Take You to Court?

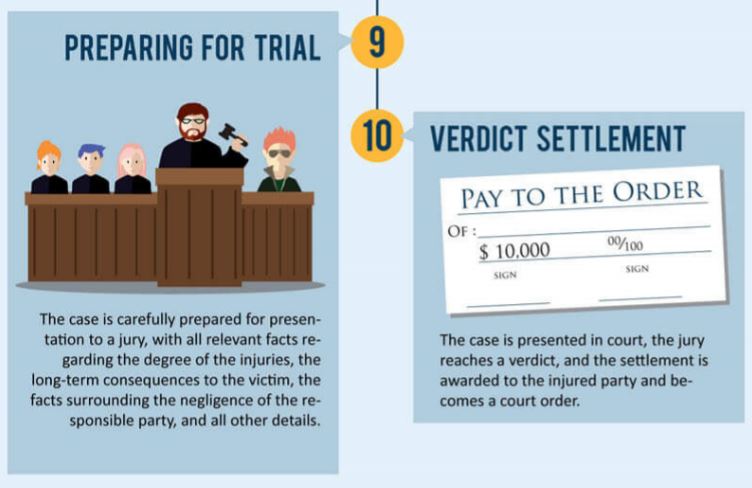

The answer is yes; payday lenders can take borrowers to court if they fail to repay the loan. When a borrower defaults, lenders may pursue legal action to recover the owed amount. This can lead to wage garnishments, bank levies, or other legal consequences. It’s essential for borrowers to be aware of their rights and the potential for litigation.

What Happens If You Default?

If you default on a payday loan, the lender may follow a series of steps before resorting to court action. Initially, they may attempt to contact you for repayment. If these attempts fail, they might sell your debt to a collection agency or file a lawsuit. It's important to note that the lender must follow legal procedures, and they cannot harass or intimidate you for payment.

Legal Protections for Borrowers

Borrowers have certain rights under federal and state laws. The Fair Debt Collection Practices Act (FDCPA) protects consumers from abusive debt collection practices. If a payday lender violates these laws, borrowers may have grounds to dispute the debt or take legal action against the lender.

Preventing Legal Action

To avoid the risk of being taken to court, borrowers should consider several strategies:

1. **Communicate with Your Lender**: If you're unable to make a payment, reach out to your lender. They may offer a payment plan or an extension.

2. **Know Your Rights**: Familiarize yourself with your rights under the FDCPA and other consumer protection laws.

3. **Seek Financial Counseling**: If you find yourself in a cycle of debt, consider seeking help from a financial counselor who can provide guidance on managing your finances and debts.

4. **Explore Alternatives**: Before taking out a payday loan, explore other options such as personal loans from banks or credit unions, which may offer better terms and lower interest rates.

In conclusion, while payday loans can provide immediate financial relief, they carry significant risks, including the potential for legal action. Understanding can payday loans take you to court is crucial for borrowers. By being informed about their rights and options, individuals can make better financial decisions and avoid the pitfalls associated with payday loans. Always consider seeking professional advice before entering into any loan agreement to safeguard your financial future.