Understanding Does Bankruptcy Discharge Student Loans: Key Insights and Implications

#### Does Bankruptcy Discharge Student LoansWhen it comes to financial struggles, many individuals often wonder about the implications of bankruptcy on thei……

#### Does Bankruptcy Discharge Student Loans

When it comes to financial struggles, many individuals often wonder about the implications of bankruptcy on their student loans. The question that frequently arises is: **does bankruptcy discharge student loans**? This inquiry is crucial for those overwhelmed by educational debt, as it can significantly influence their financial future.

#### What is Bankruptcy?

Bankruptcy is a legal process that allows individuals or entities to eliminate or repay their debts under the protection of the federal bankruptcy court. There are different types of bankruptcy, with Chapter 7 and Chapter 13 being the most common for individuals. Chapter 7 involves liquidating assets to pay off debts, while Chapter 13 allows individuals to create a repayment plan to settle their debts over time.

#### Student Loans and Bankruptcy

Student loans are a significant financial burden for many graduates. However, the treatment of student loans in bankruptcy is complex. In general, student loans are not easily dischargeable through bankruptcy. This means that simply filing for bankruptcy does not automatically eliminate student loan debt.

#### Can You Discharge Student Loans in Bankruptcy?

To discharge student loans in bankruptcy, borrowers must prove that repaying the loans would cause "undue hardship." This is a high legal standard that varies by jurisdiction. The most common test used to determine undue hardship is the Brunner Test, which requires the borrower to demonstrate:

1. They cannot maintain a minimal standard of living if forced to repay the loans.

2. Their financial situation is likely to persist for a significant portion of the repayment period.

3. They have made good faith efforts to repay the loans.

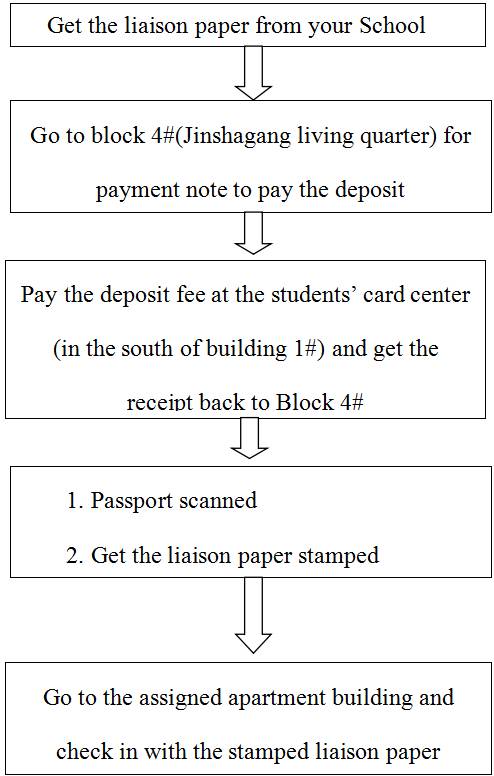

#### Steps to Consider

If you are considering bankruptcy and have student loans, here are steps to take:

1. **Consult a Bankruptcy Attorney:** It's essential to seek legal advice to understand your options and the implications of bankruptcy on your student loans.

2. **Gather Financial Documents:** Compile all relevant financial documents, including income statements, expenses, and loan information.

3. **File for Bankruptcy:** Depending on your situation, you may file for Chapter 7 or Chapter 13 bankruptcy.

4. **File an Adversary Proceeding:** If you wish to attempt to discharge your student loans, you will need to file a separate lawsuit within the bankruptcy case, known as an adversary proceeding.

#### Alternatives to Bankruptcy

Before considering bankruptcy, explore other options for managing student loan debt:

- **Income-Driven Repayment Plans:** These plans adjust your monthly payment based on your income and family size, potentially lowering your payments.

- **Loan Forgiveness Programs:** Certain professions, such as teaching or public service, may qualify for loan forgiveness after a specific period of qualifying payments.

- **Refinancing:** If you have good credit, refinancing your student loans may result in lower interest rates and monthly payments.

#### Conclusion

In conclusion, the question of **does bankruptcy discharge student loans** is a critical one for many borrowers. While bankruptcy can provide relief from various debts, student loans are typically not easily discharged unless undue hardship can be proven. It’s vital to explore all options and seek professional advice when navigating this complicated issue. Understanding your rights and obligations can help you make informed decisions about your financial future.