Understanding Equity Loan Rates: A Comprehensive Guide to Finding the Best Options

#### What Are Equity Loan Rates?Equity loan rates refer to the interest rates associated with home equity loans and home equity lines of credit (HELOCs). Th……

#### What Are Equity Loan Rates?

Equity loan rates refer to the interest rates associated with home equity loans and home equity lines of credit (HELOCs). These financial products allow homeowners to borrow against the equity they have built in their properties. The equity is essentially the difference between the market value of the home and the outstanding mortgage balance. Home equity loans typically come with fixed interest rates, while HELOCs often have variable rates that can fluctuate over time.

#### Why Are Equity Loan Rates Important?

Understanding equity loan rates is crucial for homeowners considering tapping into their home equity for various purposes, such as home improvements, debt consolidation, or funding major expenses like education or medical bills. The rates can significantly impact the total cost of borrowing, making it essential to shop around for the best deals. A lower equity loan rate can save borrowers thousands of dollars over the life of the loan.

#### Factors Influencing Equity Loan Rates

Several factors can affect equity loan rates, including:

- **Credit Score**: Lenders typically offer better rates to borrowers with higher credit scores. A strong credit history indicates a lower risk of default, leading to more favorable loan terms.

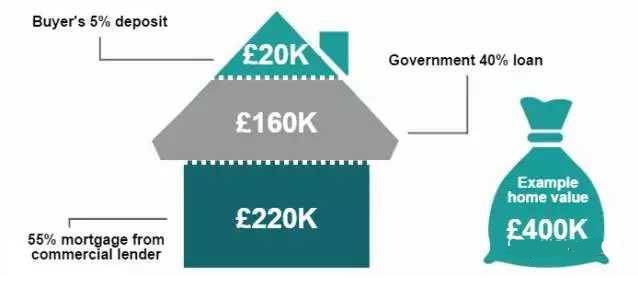

- **Loan-to-Value Ratio (LTV)**: This ratio compares the loan amount to the appraised value of the home. A lower LTV ratio generally results in better equity loan rates, as it indicates a lower risk to the lender.

- **Market Conditions**: Economic factors, including inflation, interest rates set by central banks, and overall market trends, can influence the rates lenders offer.

- **Loan Type**: The type of equity loan—whether it’s a fixed-rate home equity loan or a variable-rate HELOC—will also play a significant role in determining the interest rate.

#### How to Find the Best Equity Loan Rates

Finding the best equity loan rates requires some research and comparison shopping. Here are some steps to help you secure the best deal:

1. **Check Your Credit Score**: Before applying for a loan, obtain your credit report and check your credit score. If your score is lower than you’d like, consider taking steps to improve it before applying.

2. **Shop Around**: Don’t settle for the first offer you receive. Different lenders may have varying rates and terms, so it’s wise to compare multiple options.

3. **Consider the Fees**: In addition to interest rates, be aware of any fees associated with the loan, such as closing costs, application fees, and annual fees. These can add significantly to the overall cost.

4. **Negotiate**: Don’t hesitate to negotiate with lenders. If you have offers from multiple lenders, use them to your advantage to potentially secure a better rate.

5. **Consult a Financial Advisor**: If you’re unsure about the best course of action, consulting a financial advisor can provide personalized guidance based on your financial situation.

#### Conclusion

Equity loan rates play a vital role in determining the affordability of borrowing against your home’s equity. By understanding what influences these rates and taking steps to secure the best possible deal, homeowners can make informed decisions that align with their financial goals. Whether you’re looking to finance a home renovation or consolidate debt, being proactive in your search for favorable equity loan rates can lead to significant savings and a more manageable repayment plan.