"Understanding SBA Loan Forgiveness: Your Comprehensive Guide to Maximizing Benefits and Ensuring Approval"

#### What is SBA Loan Forgiveness?SBA Loan Forgiveness refers to the process by which borrowers can have some or all of their loans forgiven under the guide……

#### What is SBA Loan Forgiveness?

SBA Loan Forgiveness refers to the process by which borrowers can have some or all of their loans forgiven under the guidelines set by the Small Business Administration (SBA). This program is particularly relevant for businesses that received funds through the Paycheck Protection Program (PPP) or other SBA-backed loans during the COVID-19 pandemic. The goal of loan forgiveness is to provide financial relief to small businesses, allowing them to retain employees and cover essential expenses without the burden of debt.

#### Why is SBA Loan Forgiveness Important?

The importance of SBA Loan Forgiveness cannot be overstated, especially in the wake of economic challenges faced by small businesses. Many companies struggled to maintain operations and pay their employees during the pandemic, making this program a lifeline for countless entrepreneurs. By having their loans forgiven, businesses can redirect funds towards growth, innovation, and long-term stability rather than debt repayment.

#### Eligibility Criteria for SBA Loan Forgiveness

To qualify for SBA Loan Forgiveness, borrowers must meet specific criteria. Generally, the funds must have been used for eligible expenses, which include payroll costs, rent, utilities, and certain other operational expenses. Additionally, businesses must maintain their workforce levels and adhere to the guidelines set forth by the SBA. Understanding these eligibility requirements is crucial for business owners looking to maximize their chances of obtaining forgiveness.

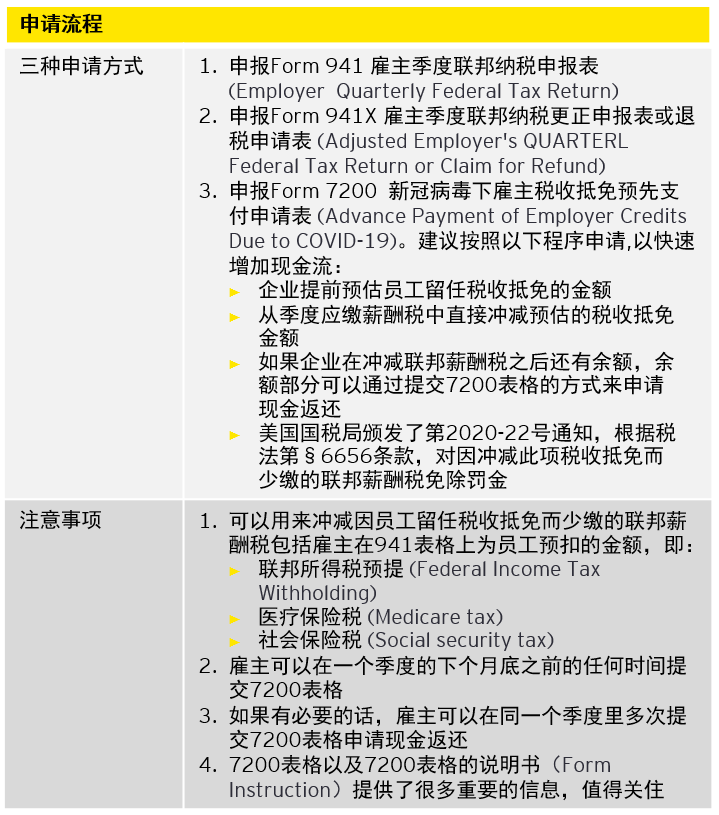

#### The Application Process for SBA Loan Forgiveness

Applying for SBA Loan Forgiveness involves several steps. First, borrowers must gather all necessary documentation, including payroll records, tax filings, and proof of eligible expenses. Next, they must complete the relevant application forms provided by their lenders. It's essential to ensure that all information is accurate and complete to avoid delays or denial of forgiveness.

Once the application is submitted, lenders will review the documentation and determine the amount eligible for forgiveness. This process can take several weeks, and borrowers should be prepared to respond to any requests for additional information from their lenders promptly.

#### Common Challenges in the SBA Loan Forgiveness Process

While the SBA Loan Forgiveness program is designed to help businesses, many borrowers face challenges during the application process. Common issues include insufficient documentation, misunderstandings about eligible expenses, and changes in workforce levels that can impact forgiveness amounts. To navigate these challenges, business owners should seek guidance from financial advisors or legal professionals who specialize in SBA loans.

#### Tips for Maximizing SBA Loan Forgiveness

1. **Keep Detailed Records**: Maintain thorough documentation of all expenses and payroll records to support your forgiveness application.

2. **Stay Informed**: Regularly check for updates on SBA guidelines and requirements, as these can change based on new legislation or economic conditions.

3. **Consult Professionals**: Engage with accountants or financial advisors who can help you understand the intricacies of the forgiveness process and ensure compliance with all requirements.

4. **Communicate with Your Lender**: Maintain open lines of communication with your lender throughout the process. They can provide valuable insights and assistance.

5. **Plan for the Future**: Even if you receive forgiveness, consider how to manage your business finances moving forward to ensure sustainability and growth.

#### Conclusion

SBA Loan Forgiveness is a vital resource for small businesses seeking to recover from economic hardships. By understanding the eligibility criteria, application process, and best practices for maximizing forgiveness, business owners can take proactive steps to secure financial relief. With careful planning and the right support, businesses can emerge stronger and more resilient in the post-pandemic landscape.