"How to Use a Monthly Calculator Car Loan to Optimize Your Auto Financing"

#### Monthly Calculator Car LoanWhen it comes to financing a vehicle, understanding the terms and calculations involved can make a significant difference in……

#### Monthly Calculator Car Loan

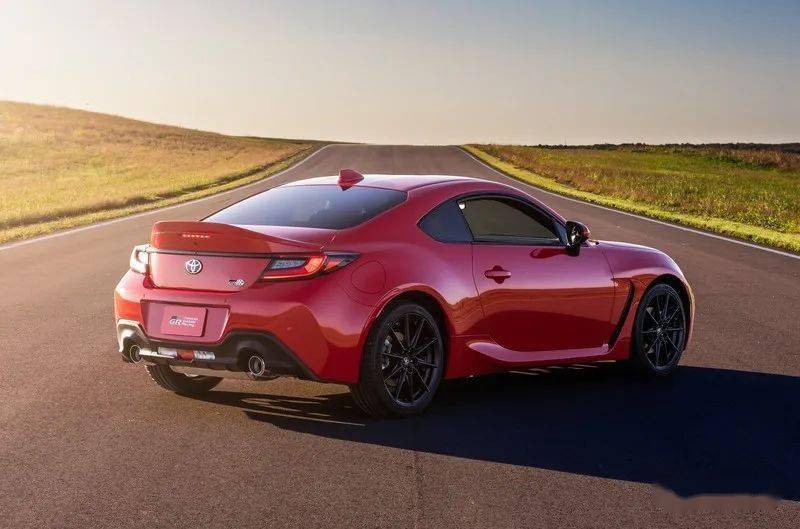

When it comes to financing a vehicle, understanding the terms and calculations involved can make a significant difference in your overall financial health. One essential tool in this process is the **monthly calculator car loan**. This calculator helps potential car buyers estimate their monthly payments based on various factors such as loan amount, interest rate, and loan term.

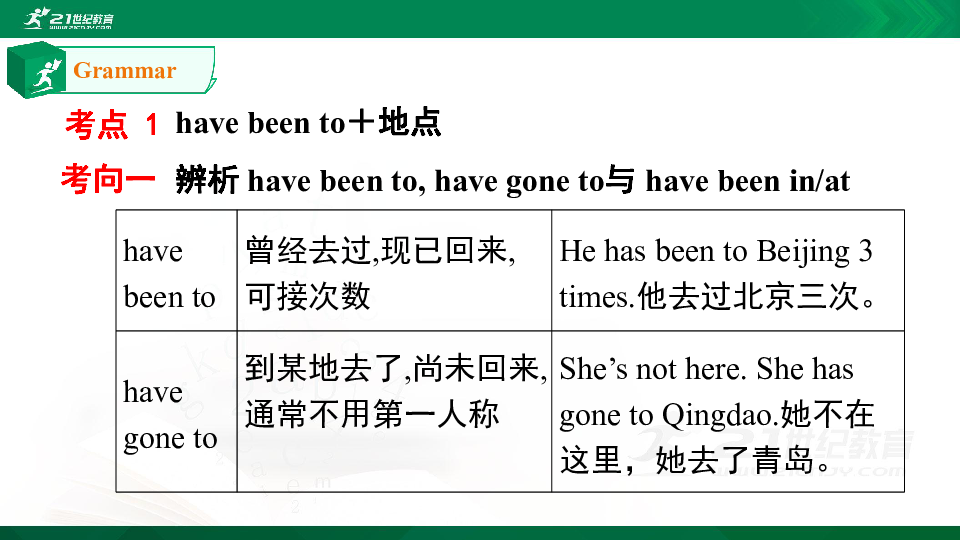

#### Understanding the Monthly Calculator Car Loan

The **monthly calculator car loan** is designed to simplify the car financing process. By inputting specific details such as the price of the car, the down payment, the interest rate, and the loan term (in months), you can get a clear picture of what your monthly payments will look like. This is crucial for budgeting and ensuring that you can comfortably afford the payments without stretching your finances too thin.

#### Key Factors to Consider

1. **Loan Amount**: This is the total amount you need to borrow, which typically includes the price of the car minus any down payment. The higher the loan amount, the higher your monthly payments will be.

2. **Interest Rate**: The interest rate is a critical factor in determining your monthly payment. A lower interest rate will result in lower monthly payments, while a higher rate will increase your payment amount. It's essential to shop around for the best rates available.

3. **Loan Term**: The length of the loan, usually expressed in months, will also affect your monthly payment. Shorter loan terms typically mean higher monthly payments but less interest paid over the life of the loan, whereas longer terms may reduce monthly payments but increase total interest costs.

4. **Down Payment**: A larger down payment reduces the loan amount, which can lead to lower monthly payments. It also shows lenders that you are financially responsible, potentially securing you a better interest rate.

#### Benefits of Using a Monthly Calculator Car Loan

Using a **monthly calculator car loan** provides several advantages:

- **Budgeting**: By estimating your monthly payments, you can better plan your budget and determine what you can afford.

- **Comparison Shopping**: You can compare different loan scenarios by adjusting the interest rate, loan amount, and term, helping you find the best deal.

- **Financial Awareness**: Understanding how different factors influence your monthly payments can empower you to make informed decisions about your car purchase.

#### Conclusion

In conclusion, utilizing a **monthly calculator car loan** is an invaluable step in the car-buying process. It enables you to visualize your potential financial commitments and make educated decisions that align with your budget and financial goals. By taking the time to understand the factors involved and using the calculator effectively, you can ensure that your auto financing experience is as smooth and beneficial as possible. Whether you're a first-time buyer or looking to refinance an existing loan, this tool is essential for navigating the complexities of car financing.