Unlocking Opportunities: A Comprehensive Guide to Commercial Vehicle Loans for Your Business Growth

#### Commercial Vehicle LoanIn the fast-paced world of business, having the right vehicles can make all the difference. Whether you’re in construction, deli……

#### Commercial Vehicle Loan

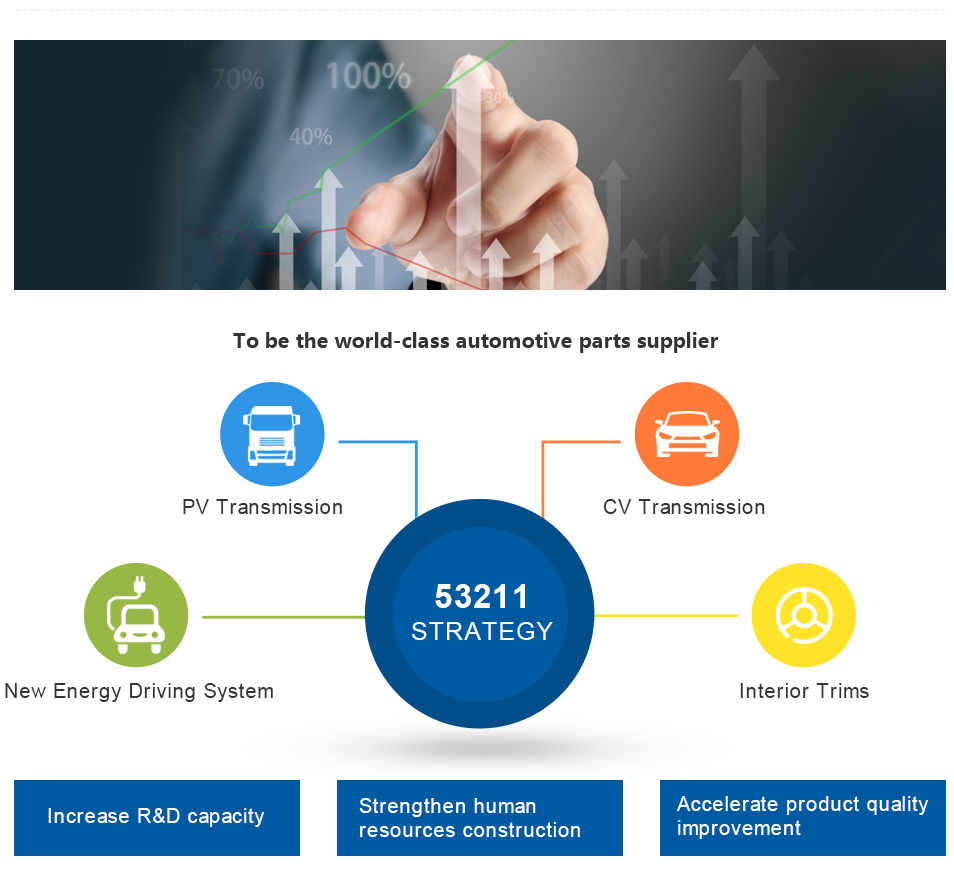

In the fast-paced world of business, having the right vehicles can make all the difference. Whether you’re in construction, delivery, or any other industry requiring transportation, a commercial vehicle loan can be the key to unlocking new opportunities. This financial product is designed specifically for businesses looking to purchase vehicles that are essential for their operations. In this guide, we will explore what a commercial vehicle loan is, its benefits, how to apply for one, and tips for securing the best rates.

#### What is a Commercial Vehicle Loan?

A commercial vehicle loan is a type of financing specifically tailored for businesses to acquire vehicles used for commercial purposes. This can include trucks, vans, buses, and other vehicles that are essential for business operations. Unlike personal vehicle loans, commercial vehicle loans often come with different terms, interest rates, and repayment structures that cater to the unique needs of businesses.

#### Benefits of a Commercial Vehicle Loan

1. **Improved Cash Flow**: By financing your vehicle purchase through a commercial vehicle loan, you can preserve your working capital. This enables you to allocate funds to other critical areas of your business.

2. **Tax Deductions**: Many businesses can benefit from tax deductions associated with vehicle purchases. Interest paid on a commercial vehicle loan may be tax-deductible, which can help lower your overall tax burden.

3. **Flexible Terms**: Lenders often provide various loan terms, allowing businesses to choose a repayment plan that fits their cash flow and budget. This flexibility can be crucial for managing expenses effectively.

4. **Build Business Credit**: Successfully managing a commercial vehicle loan can help build your business’s credit profile, making it easier to secure future financing for other needs.

#### How to Apply for a Commercial Vehicle Loan

Applying for a commercial vehicle loan is a straightforward process, but it requires some preparation. Here are the steps you should follow:

1. **Assess Your Needs**: Determine the type of vehicle you need and how it will benefit your business. This assessment will help you choose the right loan amount.

2. **Check Your Credit Score**: Lenders will evaluate your creditworthiness before approving a loan. Ensure your credit score is in good standing to secure better interest rates.

3. **Gather Documentation**: Prepare necessary documents, including business financial statements, tax returns, and details about the vehicle you intend to purchase.

4. **Shop Around**: Different lenders offer varying terms and interest rates. Compare offers from banks, credit unions, and specialized lenders to find the best deal.

5. **Submit Your Application**: Once you’ve chosen a lender, submit your application along with the required documentation. Be prepared to answer questions about your business and its financial health.

6. **Review Loan Terms**: If approved, carefully review the loan terms before signing. Ensure you understand the interest rate, repayment schedule, and any fees associated with the loan.

#### Tips for Securing the Best Commercial Vehicle Loan

- **Improve Your Credit Score**: Before applying, take steps to improve your credit score. Pay down existing debts and ensure all bills are paid on time.

- **Consider a Larger Down Payment**: A larger down payment can reduce the amount you need to borrow, which may result in lower monthly payments and interest rates.

- **Negotiate Terms**: Don’t hesitate to negotiate with lenders. They may be willing to offer better terms based on your business’s financial health.

- **Read the Fine Print**: Always read the fine print of your loan agreement to avoid any surprises later on.

In conclusion, a commercial vehicle loan can be a powerful tool for businesses looking to expand their operations and improve efficiency. By understanding the benefits, application process, and strategies for securing favorable terms, you can make informed decisions that contribute to your business’s success. Whether you’re a startup or an established company, investing in the right vehicles through a commercial vehicle loan can drive your business forward.