Unlocking Your Homeownership Dreams: The Ultimate Mortgage Loan Calculator Based on Credit Score

#### IntroductionIn today's competitive real estate market, understanding your financial options is crucial. One of the most effective tools at your disposa……

#### Introduction

In today's competitive real estate market, understanding your financial options is crucial. One of the most effective tools at your disposal is the **mortgage loan calculator based on credit score**. This innovative calculator not only simplifies the mortgage process but also helps you gauge how your credit score influences your borrowing power. In this article, we will delve into the significance of this calculator, how it works, and why it is essential for prospective homebuyers.

#### What is a Mortgage Loan Calculator Based on Credit Score?

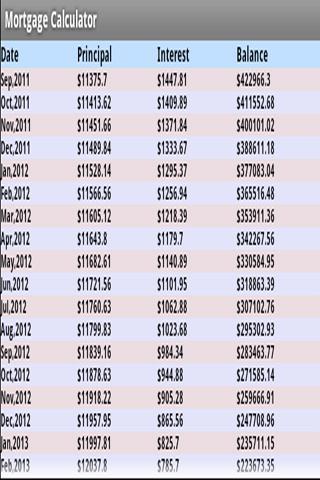

A **mortgage loan calculator based on credit score** is an online tool that allows potential homebuyers to estimate their monthly mortgage payments based on various factors, including their credit score. By inputting your credit score, the calculator can provide tailored estimates of interest rates, loan amounts, and monthly payments, giving you a clearer picture of what you can afford.

#### Why Your Credit Score Matters

Your credit score plays a pivotal role in determining the terms of your mortgage. Lenders use this score to assess your creditworthiness and the risk associated with lending to you. A higher credit score typically translates to lower interest rates, which can significantly reduce your monthly payments and the overall cost of your loan. Conversely, a lower credit score may result in higher interest rates or even disqualification from certain loan products.

#### How to Use the Mortgage Loan Calculator

Using the **mortgage loan calculator based on credit score** is straightforward:

1. **Input Your Credit Score**: Start by entering your current credit score. If you're unsure of your score, consider checking it through a reputable credit reporting agency.

2. **Enter Loan Details**: Input the desired loan amount, loan term (in years), and any additional details such as down payment percentage.

3. **Calculate**: Hit the calculate button to receive an estimate of your monthly payments, total interest paid, and the overall cost of the loan.

4. **Adjust Variables**: Experiment with different credit scores, loan amounts, and terms to see how these changes affect your monthly payments.

#### Benefits of Using the Calculator

1. **Personalized Estimates**: The calculator provides tailored estimates based on your unique credit situation, helping you make informed decisions.

2. **Budget Planning**: By understanding your potential monthly payments, you can better plan your budget and determine how much house you can afford.

3. **Comparison Shopping**: Use the calculator to compare different loan scenarios, allowing you to find the best mortgage option for your needs.

4. **Empowerment Through Knowledge**: Armed with the information from the calculator, you can approach lenders with confidence, knowing what to expect based on your credit score.

#### Conclusion

In conclusion, the **mortgage loan calculator based on credit score** is an invaluable resource for anyone looking to buy a home. By understanding how your credit score impacts your mortgage options, you can take proactive steps to improve your score and secure the best possible loan terms. Whether you're a first-time homebuyer or looking to refinance, utilizing this calculator can help unlock the door to your homeownership dreams. Take charge of your financial future today by exploring your mortgage options with this powerful tool!